The News: Online brokerage Webull is planning to go public via a $7.3 billion merger with a special purpose acquisition company (SPAC), after previous initial public offering (IPO) attempts were unsuccessful, partly due to its past crypto offerings.

Details: The New York-based company, which launched its trading platform in the U.S. in 2018, has agreed to merge with SK Growth Opportunities Corp. The company plans to start trading on the Nasdaq in the second half of 2024, giving Webull an estimated enterprise value of roughly $7.3 billion.

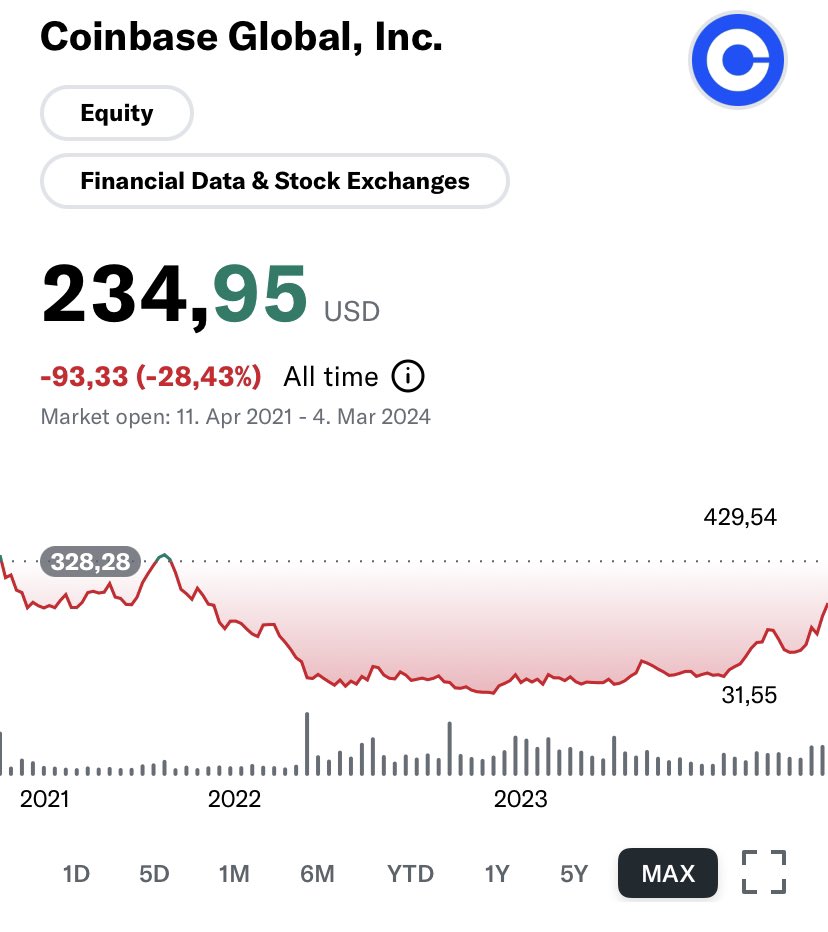

Webull’s U.S. CEO, Anthony Denier, stated that the company’s previous attempts to IPO were hindered by its cryptocurrency trading offerings, a practice the SEC has frowned upon. To eliminate this regulatory uncertainty and clear the path for its public listing, Webull sold its crypto asset business in late 2023.

Why SPAC?: Denier explained that the SPAC route provides a more certain valuation upfront compared to a traditional IPO. The blank-check deal is expected to raise approximately $100 million for Webull, which it intends to use for international expansion and new product development.

Webull experienced significant growth during the pandemic, with registered users reaching 20 million worldwide. The company has targeted more active traders than competitors like Robinhood, offering tools for technical analysis.

It’s important to note that this impending public listing occurs as fintechs proceed cautiously due to increased regulatory scrutiny of companies with ties to China. Despite early backing from Chinese tech giants Xiaomi and Alibaba, Denier emphasized that Webull is not majority-owned by Chinese entities.