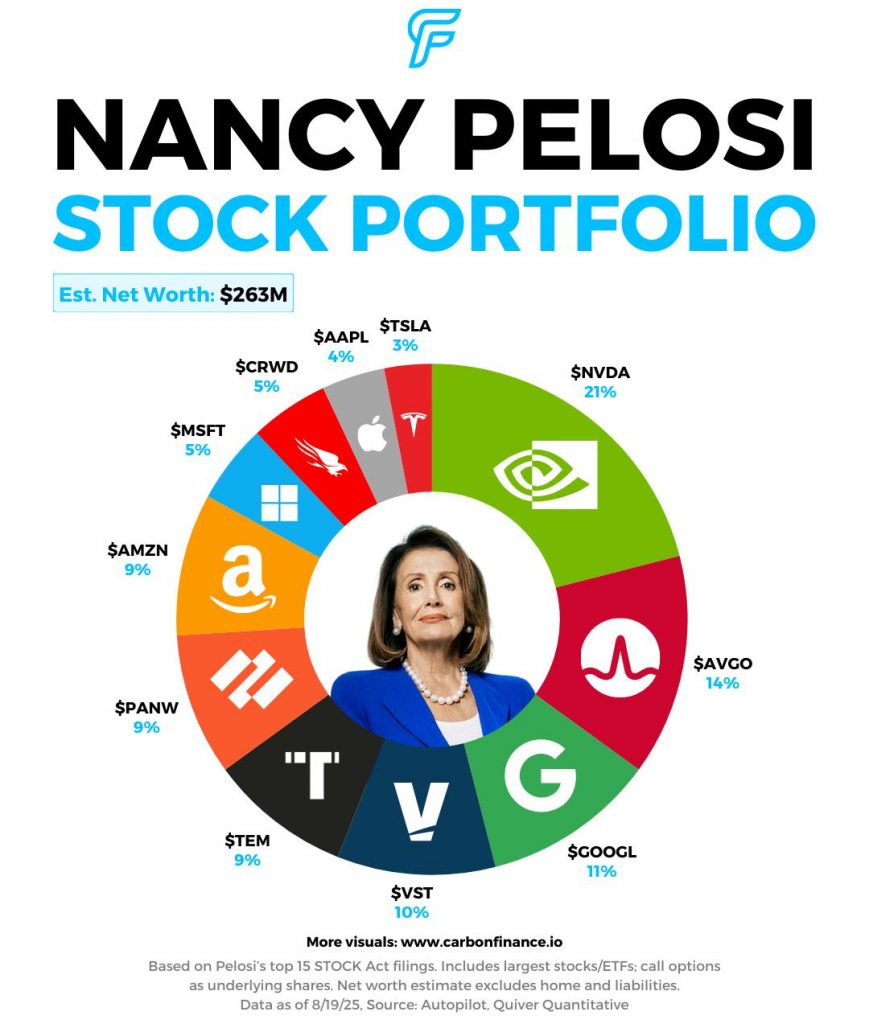

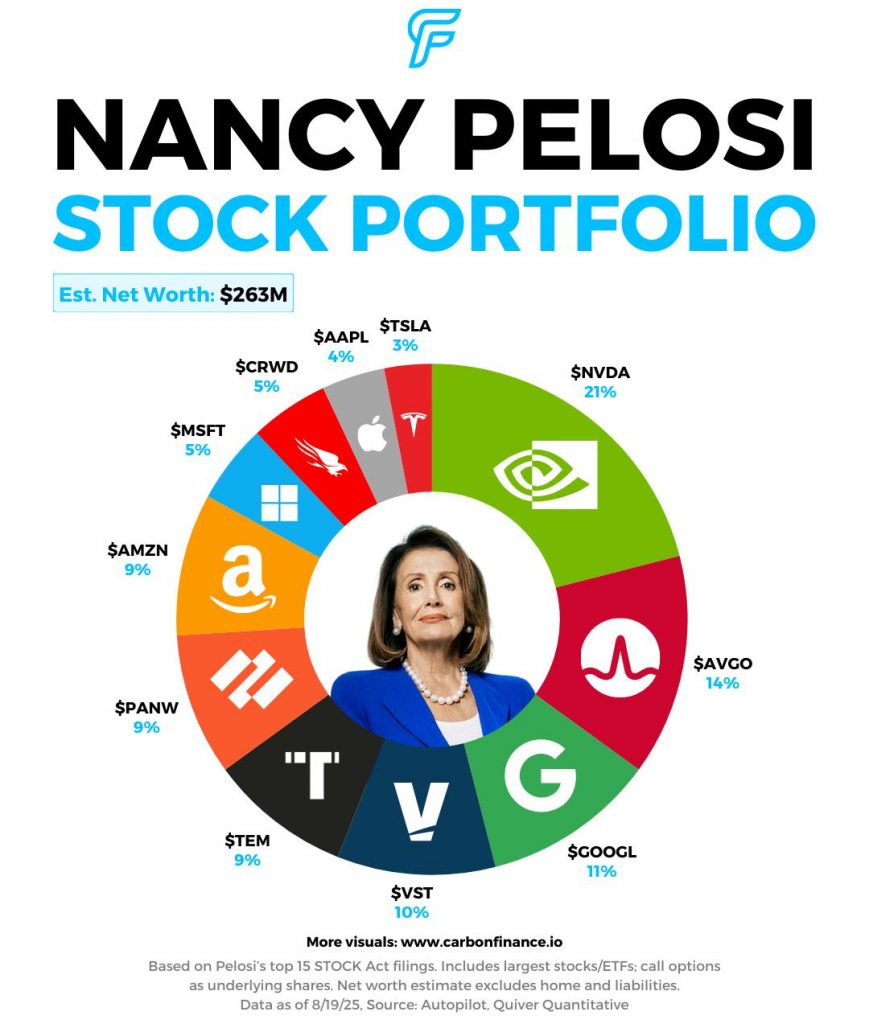

Nancy Pelosi has made some changes to her stock portfolio of late and here is how it looks as at today.

Nancy keeps adding to her Palo Alto Networks (PANW) position. I think there is a lot of opportunity there.

Tech, Business, Finance and Everything Else

Nancy Pelosi has made some changes to her stock portfolio of late and here is how it looks as at today.

Nancy keeps adding to her Palo Alto Networks (PANW) position. I think there is a lot of opportunity there.

David Vélez, Nubank’s CEO and co-founder, just sold 33 million Class A shares (around 0.7% of the company’s total shares) through Rua California Ltd. He said it was for personal asset planning—about 3.5% of his stake.

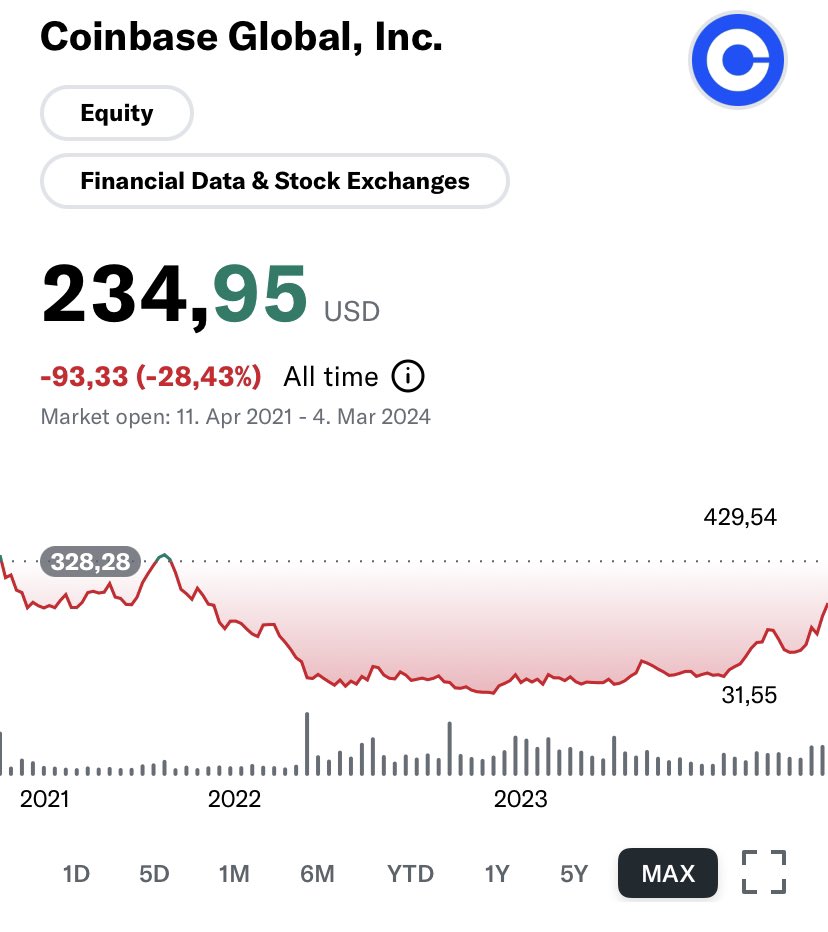

Coinbase (COIN) debuted on the Nasdaq stock exchange on April 14, 2021, through a direct listing, meaning no shares were sold at a pre-determined price. While Nasdaq provided a reference price of $250 per share, the stock actually began trading at $381 and closed its first day at $328.28 per share.

Dividend investing can be considered better than standard long-term investing for capital growth returns due to several reasons:

It’s important to note that the choice between dividend investing and standard long-term investing depends on individual preferences, risk tolerance, and investment goals. Both approaches have their advantages and drawbacks, and it’s essential to consider one’s specific financial situation before making investment decisions.

No, Instacart does not have a dual-class share structure in place. As of January 8, 2024, Instacart has a single class of common stock, which means that all shareholders have equal voting rights and receive the same dividends per share.

This differs from many other tech startups, which often opt for dual-class share structures. In a dual-class structure, there are typically two classes of shares: Class A and Class B. Class A shares typically have one vote per share, while Class B shares might have 10 or even 100 votes per share. This gives the founders and early investors more control over the company, even if they don’t own a majority of the shares.

While the main benefits of dual-class structures often revolve around founder control and long-term focus, there are indeed other potential advantages to consider:

Increased Efficiency in Decision-Making: With a smaller group holding significant voting power, decision-making processes can be faster and more streamlined. This can be particularly advantageous for startups and agile companies needing to adapt quickly to market changes.

Attract Investors with Different Risk Appetites: Dual-class structures can attract two distinct types of investors: those seeking higher voting power and control alongside potentially higher risks, and those who prioritize lower voting power but potentially more stable and predictable returns. This diversification can benefit the company by bringing in a wider range of capital and expertise.

Enhanced Focus on Innovation: As founders and management hold more control, they can direct resources towards long-term innovative projects that may not immediately yield profits, potentially leading to breakthroughs and competitive advantages in the future.

Protection Against Activist Investors: The entrenched control by founders can offer a shield against short-termist activist investors who might push for decisions that prioritize immediate financial gains over long-term value creation.

Improved Shareholder Alignment: If super-voting shares are distributed strategically to key executives and senior leadership, their interests become more closely aligned with those of the overall shareholder base, potentially leading to better decision-making in the long run.

Global Competitiveness: Dual-class structures are more common in certain countries like the US and China, where public markets might be less forgiving of long-term investment strategies. This can give companies from these regions a competitive edge when facing companies from jurisdictions with a stricter one-share-one-vote approach.

However, it’s crucial to remember that these potential benefits are not guaranteed and depend on various factors like the specific design of the dual-class structure, the company’s governance practices, and the overall market context. As with any business decision, weighing the potential benefits and drawbacks with careful consideration is key before implementing a dual-class structure.

Bill Gates currently owns about 1.38% of Microsoft’s shares. This makes him the largest individual shareholder in the company. However, his ownership stake has declined significantly over the years. In the late 1980s, Gates owned over 40% of Microsoft’s shares.

Gates has sold millions of shares of Microsoft stock over the years to fund his charitable foundation, the Bill & Melinda Gates Foundation. He has also donated shares directly to the foundation.

Despite his reduced ownership stake, Gates remains a major figure at Microsoft. He serves as a technology advisor to the company and is still active in its decision-making process.

Larry Page owns approximately 23.8 million shares of Unity Technologies, according to the company’s June 29, 2023, 13F filing with the Securities and Exchange Commission (SEC). His stake in the company is valued at over $2.3 billion, based on Unity’s closing stock price on August 4, 2023.

Page became a shareholder in Unity Technologies in 2019, when he led a $120 million investment round in the company. He is also a member of Unity’s board of directors.

Unity Technologies is a software company that develops a platform for creating and operating real-time 3D content. The company’s platform is used to create video games, movies, television shows, and other interactive experiences.

Unity Technologies is a publicly traded company, and its shares are listed on the Nasdaq stock exchange under the ticker symbol “U.”

Spotify’s A class and B class shares differ in two key ways:

Other than these two differences, Class A and Class B shares have the same rights and obligations. This means that they receive the same dividends and have the same right to participate in any liquidations or distributions.

The largest shareholder of LVMH is the Arnault Family Group, which is controlled by Bernard Arnault. The Arnault Family Group owns approximately 46.84% of LVMH’s stock and 63.13% of its voting rights.

Other major shareholders of LVMH include:

These shareholders collectively hold over 50% of LVMH’s outstanding shares.

It is important to note that these percentages are based on the number of Class A shares outstanding. LVMH also has Class B shares, which have ten times the voting power of Class A shares. As a result, Bernard Arnault, who owns a majority of the Class B shares, has a significant amount of control over the company.

The CEO of MongoDB, Dev Ittycheria, owns 218,085 shares of MongoDB stock. As of July 27, 2023, these shares are worth approximately $89 million. This represents about 0.22% of the company’s outstanding shares.

Ittycheria has been the CEO of MongoDB since 2014. He is also a director of Datadog Inc. and athenahealth Inc. His total yearly compensation is $13.23 million, comprised of 3% salary and 97% bonuses, including company stock and options.

Ittycheria’s ownership of MongoDB stock has increased significantly in recent years. In 2014, he owned just 16,000 shares of the company. However, he has since exercised stock options and purchased additional shares on the open market.

Ittycheria’s ownership of MongoDB stock gives him a significant financial stake in the company’s success. It also gives him a strong voice in the company’s strategic direction.

Michael Cannon-Brookes owns approximately 109.44 million Class B shares and 381,836 Class A shares of Atlassian. This represents approximately 43.08% of Atlassian’s outstanding Class B and Class A ordinary shares, taken together, and approximately 87.91% of the voting power.

In other words, Cannon-Brookes owns about 22% of Atlassian’s total shares, but he has control over about 88% of the company’s voting power. This is because Class B shares have ten times the voting power of Class A shares.

Cannon-Brookes is the co-founder and co-CEO of Atlassian, and he is one of the richest people in Australia. His net worth is estimated to be around $13 billion.

(as at May 2022)

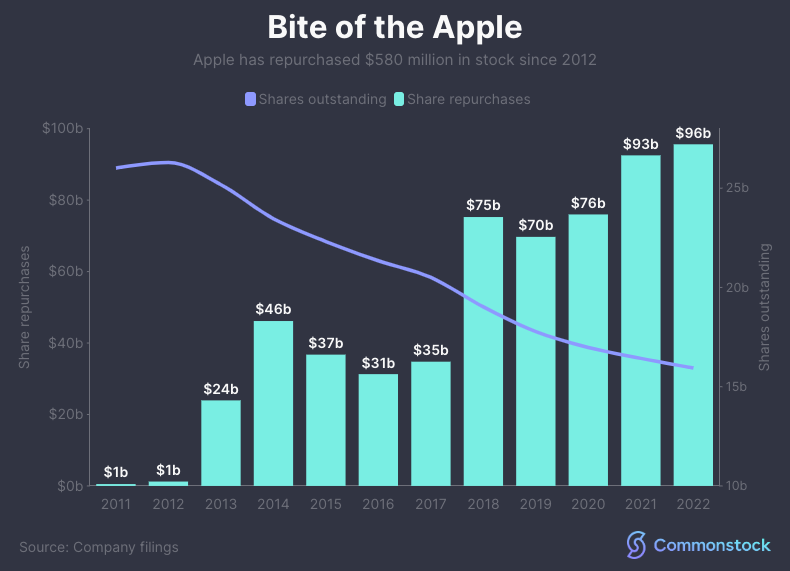

Since 2012, when Apple’s share count peaked, the company have repurchased more than $580 billion in stock.

That’s ~38% of the outstanding share count in ten years.

Even if the revenues remained flat the share price would increase and you would be far better off purely for holding.

Warren Buffett and Berkshire Hathaway hold a huge number of Apple stock – they must be laughing!

Berkshire Hathaway is a holding company owned by Warren Buffett and is one of the most successful and well-known businesses in the world. The company has two classes of stock, A and B, and the two stocks have some important differences. In this post, we’ll explore the difference between the two types of stock and what that means for investors.

Berkshire Hathaway Class A shares are the company’s original stock, and are traded on the New York Stock Exchange under the ticker symbol BRK.A. Class A shares are the most expensive, currently trading around $350,000 per share. The stock is known for its high dividend yield, and investors receive one vote per share when voting at the company’s annual meeting.

Berkshire Hathaway’s Class B shares are much more affordable, trading around $250 per share. The stock still carries the ticker symbol BRK.B and still pays a dividend, though it is not as high as the Class A stock. In addition, Class B shares only carry one-tenth of the voting power of Class A shares.

Berkshire Hathaway A stock and B stock are two classes of stock offered by the company. Class A stock is the most expensive, but carries more voting power and a higher dividend yield. Class B stock is more affordable and pays a dividend, though it carries much less voting power. Both classes of stock offer investors a chance to benefit from the long-term success of Berkshire Hathaway.

Great little video about why Warren Buffett started a partnership and not a mutual fund. Its all about the terminology.

Over the past month Elon Musk has unloaded $10 billion worth of Tesla shares.

Currently Elon still ranks No. 1 on the global Bloomberg Billionaires Index, with a net worth of $284 billion.

Here is a great video on some of Warren Buffett’s very simple ideas and principles. It doesn’t elaborate on some of the key points, but it’s a great starting point.

Yes.

Monday.com has just gone public and now anyone can buy shares in the productivity software giant.

Stock Ticket: MNDY

For analysis and information please take a look at Yahoo Finance.

Tesla shares have finished the day at 21.06% down. This is the biggest single day share decline for the company in its history.

Why this matters: Tesla is a company going after a big dream. However, it also seems to be the company that is riding a very high valuation based on very little fundamental numbers being it. Revenues have increase 14% in the past 12 months, but the share price has increased 573%.

My views: I love the company and I love what they are trying to achieve, but it seems like they have become the poster child for a heavily overpriced stock market based on poor fundamentals.

There is very little difference between Berkshire Hathaway’s BRK.A and BRK.B shares.

BRK.B shares were created because Warren Buffett noticed that the BRK.A shares were growing considerable high is cost per share and that these shares were less obtainable by the average retail investor and could only be purchased by either very wealth individuals, unit trusts or mutual funds.

Thus, Warren decided to create BRK.B shares to provide the average investor with the opportunity to purchase shares in Berkshire Hathaway without the huge cost associated with BRK.A.

There are other very small differences, but the above is the only one that really counts.