This is getting a little crazy. Lululemon is down to 13x earnings.

I know they have a lot more competition now than they had 2 years ago. However, they are still only focused on the female population.

Tech, Business, Finance and Everything Else

This is getting a little crazy. Lululemon is down to 13x earnings.

I know they have a lot more competition now than they had 2 years ago. However, they are still only focused on the female population.

TikTok’s UK subsidiary has published its latest financial results covering operations in Europe, the UK, Latin America and Africa. The report shows revenue growth of 38% to $6.31bn in 2024, while the company significantly reduced its operating losses from $1.37bn in 2023 to $484.6m last year.

Filed with Companies House in the UK, these results primarily address financial performance rather than user statistics. However, earlier this year TikTok separately disclosed user numbers for the European Union. The platform reached 159 million monthly active users across the EU by the end of 2024, with its largest markets being France (25.1 million), Germany (24.2 million), Italy (22.8 million) and Spain (21.9 million).

TSMC has just released their Q2 2024 Earnings.

EPS: $1.48 vs $1.39 estimate

Revenue: $20.82 billion vs $20.06 billion estimate

Gross margin for the quarter was 53.2%, operating margin was 42.5%, and net profit margin was 36.8%. For Q3 2024 TSMC expect revenue between $22.4-$23.2 billion. The middle is well above the estimate of $22.65 billion.

This seems like another good quarter for TSMC overall, but so far the market has pushed down the share price and now it is trading at a forward P/E of 23

Time to buy??

MasterCard doesn’t make money directly from consumers using their cards. Instead, they generate revenue through several key channels:

1. Assessments: This is the main source of income, accounting for roughly 28% of Mastercard’s revenue. Assessment fees are charged to financial institutions that issue Mastercard-branded cards based on the gross dollar volume (GDV) of transactions made using those cards. The higher the GDV, the higher the fee.

2. Transaction fees: This accounts for about 34% of their revenue. These are small fees charged to merchants every time a Mastercard is used for a purchase. This fee is typically a percentage of the transaction amount and a fixed fee.

3. Cross-border fees: When a Mastercard is used in a different country than the one where it was issued, additional fees are charged, contributing around 23% of Mastercard’s revenue. These fees cover currency conversion and other costs associated with cross-border transactions.

4. Other revenue: This includes smaller sources of income like data analytics services, consulting fees, and licensing fees for Mastercard technology.

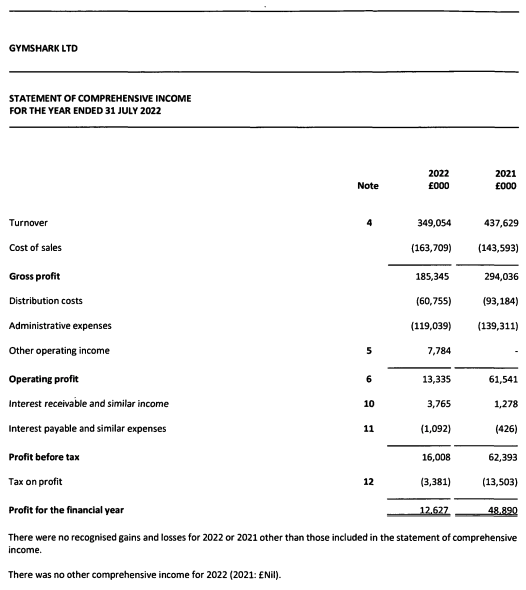

Gymshark has now had to restate their 2022 financial figures and now there is a 20% loss of revenues for 2022.

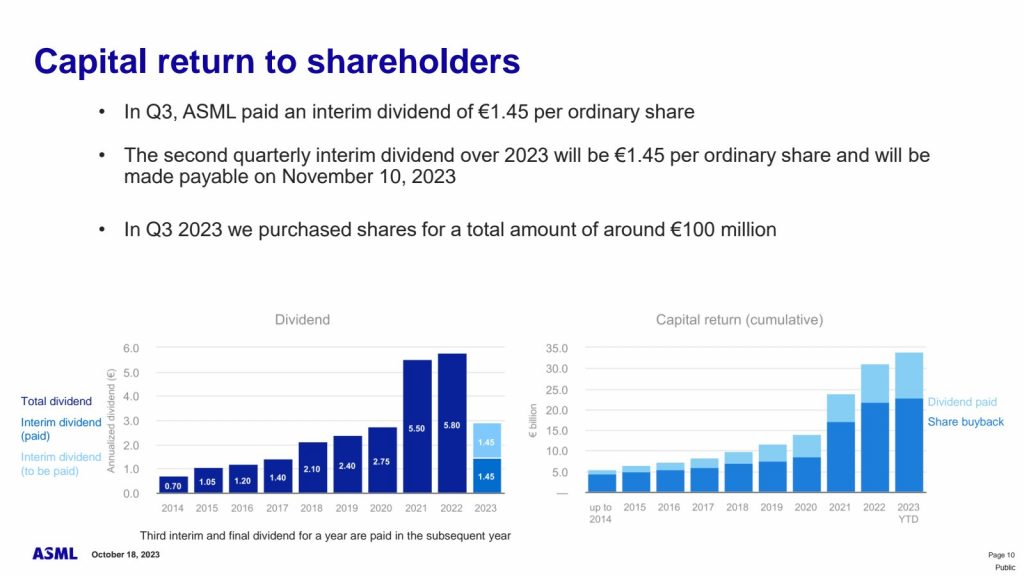

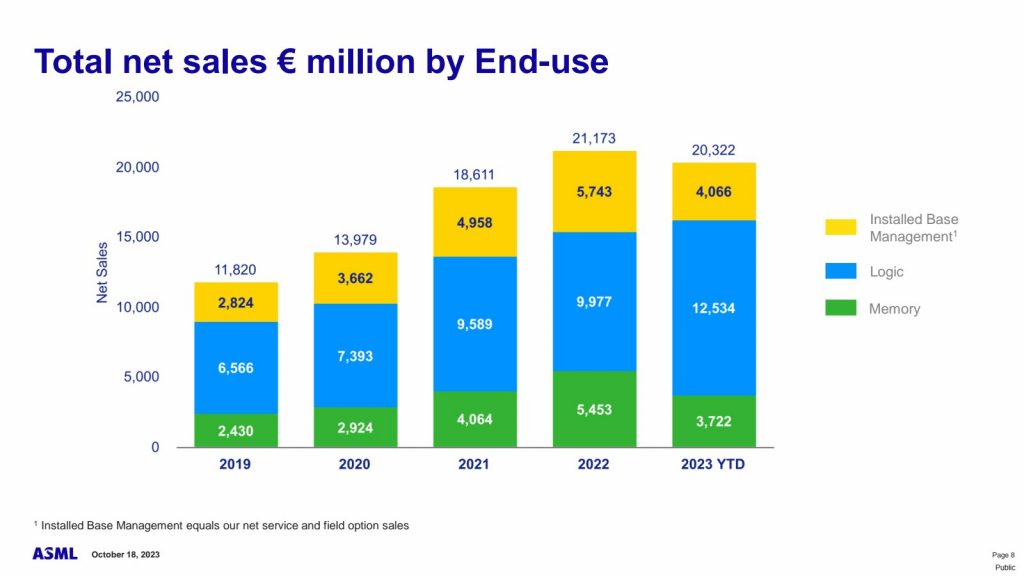

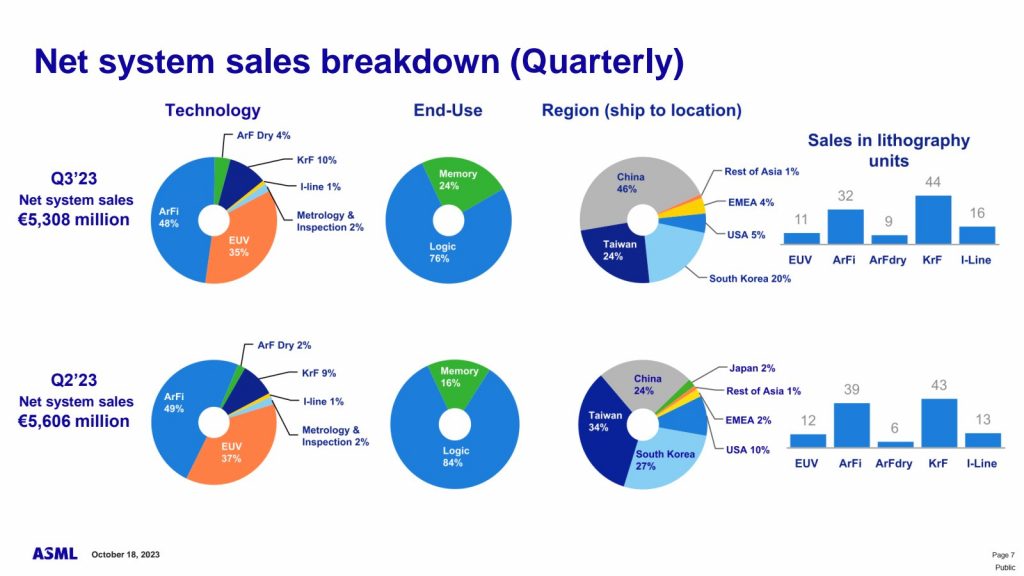

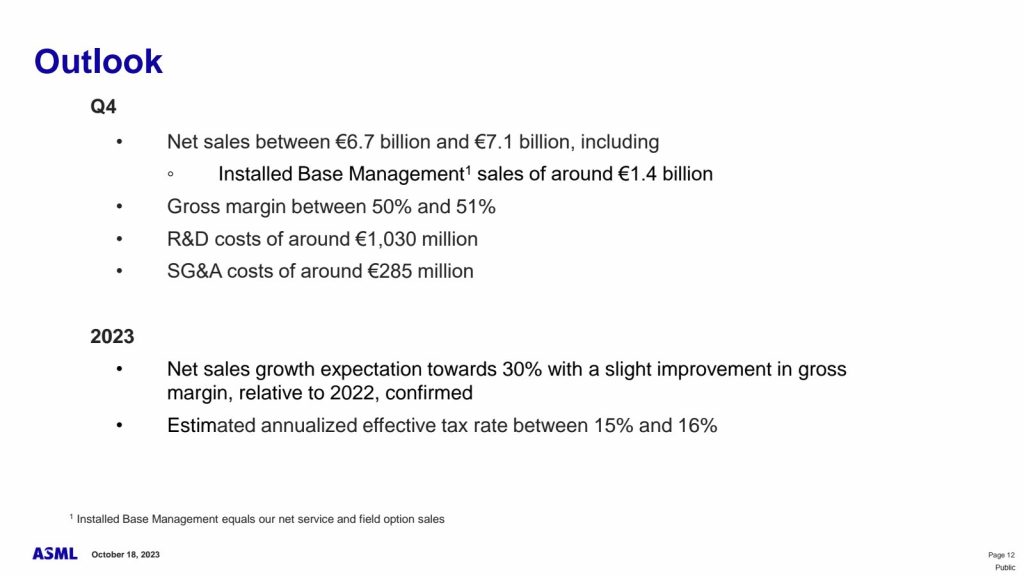

$ASML‘s Net Bookings are under pressure amidst the industry down-cycle, however, the equipment giant expects “significant growth” in 2025 – as per today’s Q3 report.

Q3 2023 (y/y)

Net Bookings -70%

Net Sales +15%

*Lithography systems +30%

EBIT +13%

*Margin 32.7% (33.5)

Net Income +11%

*Margin 28.4% (29.4)

EPS +12% FCF -23%

Industry Cycle Bottom? “The semiconductor industry is currently working through the bottom of the cycle and our customers expect the inflection point to be visible by the end of this year” – CEO, Peter Wennink

Two-Year Outlook “Based on our current perspective, we take a more conservative view [on 2024] and expect a revenue number similar to 2023. But we also look at 2024 as an important year to prepare for significant growth that we expect for 2025.” – CEO, Peter Wennink

Alphabet, Google’s parent company, reported gross profit of \$280.126 billion in the fiscal year 2022. As of March 31, 2023, Google had 163,959 employees, which means that the company’s gross profit per employee in 2022 was \$1,708,512.

Google’s gross profit margin is calculated by dividing the company’s gross profit by its revenue. In 2022, Google’s gross profit margin was 62.44%.

Google’s gross profit is generated from its advertising business, which includes search ads, display ads, and video ads. The company also generates revenue from its cloud computing business, its hardware business, and its other businesses.

Google’s gross profit per employee is one of the highest in the tech industry. This is due to the company’s strong competitive position in the online advertising market and its ability to generate high-margin revenue from its cloud computing business.

As of February 3, 2023, Atlassian’s CEO, Scott Farquhar, owns 54,717,824 Class B shares. This represents 15.5% of the company.

Farquhar is the co-founder and CEO of Atlassian, a software company that develops products for software development teams. He has been with the company since its inception in 2002. Farquhar is a visionary leader who has helped to transform the software development industry with Atlassian’s cloud-based software solutions. He is also a strong advocate for corporate social responsibility and employee success.

Spotify, the world’s leading music streaming service, today announced strong financial results for the second quarter of 2023. The company’s revenue grew 11% year-over-year to €3.2 billion, and its monthly active users (MAUs) grew 27% to 551 million. Spotify’s premium subscribers grew 17% to 220 million, and its advertising revenue grew 30% to €243 million.

Spotify’s CEO, Daniel Ek, said that the company is “very pleased” with its second quarter results. He attributed the company’s growth to its “strong global expansion,” its “continued focus on innovation,” and its “growing partnerships with the music industry.”

Ek also said that Spotify is “well-positioned for continued growth in the years to come.” He pointed to the company’s “large and growing user base,” its “strong financial position,” and its “continued investment in innovation” as reasons for his optimism.

Spotify’s results come at a time when the music streaming industry is booming. In 2022, the global music streaming market was worth an estimated $25.6 billion. This is up from just $7.3 billion in 2015. The growth of the music streaming industry is being driven by a number of factors, including the increasing popularity of smartphones and tablets, the growing availability of high-speed internet, and the rising cost of traditional music formats, such as CDs and vinyl.

Spotify is one of the leading players in the music streaming industry. The company has a significant market share in both developed and emerging markets. Spotify is also one of the most innovative companies in the industry. The company has been at the forefront of developing new features, such as personalized playlists and podcasts.

Spotify’s strong financial results and its leading position in the music streaming industry suggest that the company is well-positioned for continued growth in the years to come.

Here are some additional details from the article:

Spotify’s management team is optimistic about the company’s future. They said that they expect Spotify to continue to grow its user base and revenue in the years to come. They also said that they are committed to investing in innovation and partnerships with the music industry.thumb_upthumb_downtuneshareGoogle it

This morning we posted about Believe Digital acquiring Sentric Music Publishing.

I wanted to provide a little more context about the acquisition.

Sentric – Companies House accounts – https://find-and-update.company-information.service.gov.uk/company/05721428/filing-history

2021 Year End Numbers:

Acquisition price was $51 million.

It feels like this was a good price on both counts. Utopia obviously sold Sentric at a discount, but they really need to get rid of the asset (they only purchased a year ago). Believe got a good asset in a new market – at a reasonable multiple.

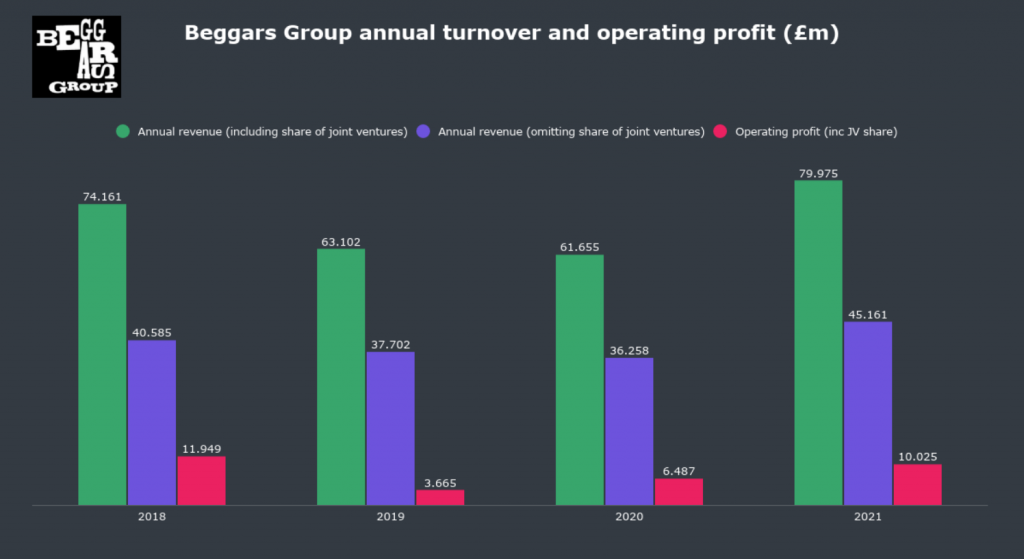

Beggars Music Group had a strong 2021 (as they have just released their numbers in a filing on UK Companies House).

Beggars Group generated GBP 79.98 million in 2021 – which was up 29.7% year on year.

This figure includes Beggars’ share of various joint venture businesses including XL Recordings, Matador and Rough Trade, in each of which Beggars owns 50%.

Beggars is a huge player in independent music market and it’s great to see that they are still growing strong and getting a strong slice of the market.

Alex Bouaziz the co-founder and CEO of Deel has just announced some of their recent numbers on Twitter.

In 2021 –

That is one of the craziest years I have ever heard.

Inspirato is a luxury vacation home rental startup that simply just lets you pay a subscription to access unlimited rentals for $2500/month or on-demand rates with a $600/month subscription.

Its 18,000 members can book 1,200 vacation homes in 395 locations.

My Thoughts:

Somehow Inspirato is going public at what looks like might be a $1 billion valuation. Based on the numbers there is potential the company has a $45 million revenue. We have to be in a bubble for anyone to consider this type of business thats growing at 30% year on a year – to be valued anywhere near $1 billion.

Deliveroo is planning to go public at a valuation of around $7 billion USD. Here is a quick breakdown of some of their numbers that have just been released.

These number make for hard reading, but it seems like there is a real path towards profitability – but it feels like it is going to really require mass scale of nearly £10 billion per year in GTV to get there.

However, Deliveroo have the ability to start new product lines and delivering in other areas as well as corporate contracts, plus geographic expansion.

Technology stocks are currently dropping fast – so it will be interesting to see if there is an appetite on the London Stock Market for a heavy losing technology company with growing scale.

Amuse.io is a new music upstart that has been getting a lot of press of late. Amuse.io has just released their official 2019 financials and it’s very interesting reading.

Revenues = $9.5 million USD

Profit / Loss = $10.9 million USD Loss

Staff = 49 staff

Cash Liquidity = 208%

This basically means that Amuse will need to raise another round of Venture Capital within the remainder of 2020 or start of 2021 to be able to survive.

Source – https://www.merinfo.se/foretag/Amuseio-AB-5590367016/2kgcyso-1hslk