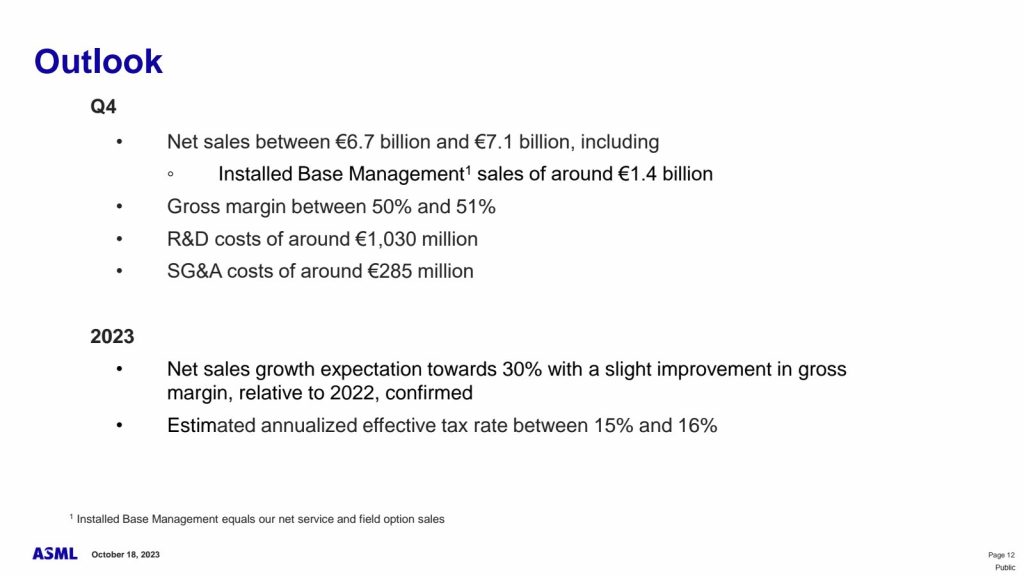

$ASML‘s Net Bookings are under pressure amidst the industry down-cycle, however, the equipment giant expects “significant growth” in 2025 – as per today’s Q3 report.

Q3 2023 (y/y)

Net Bookings -70%

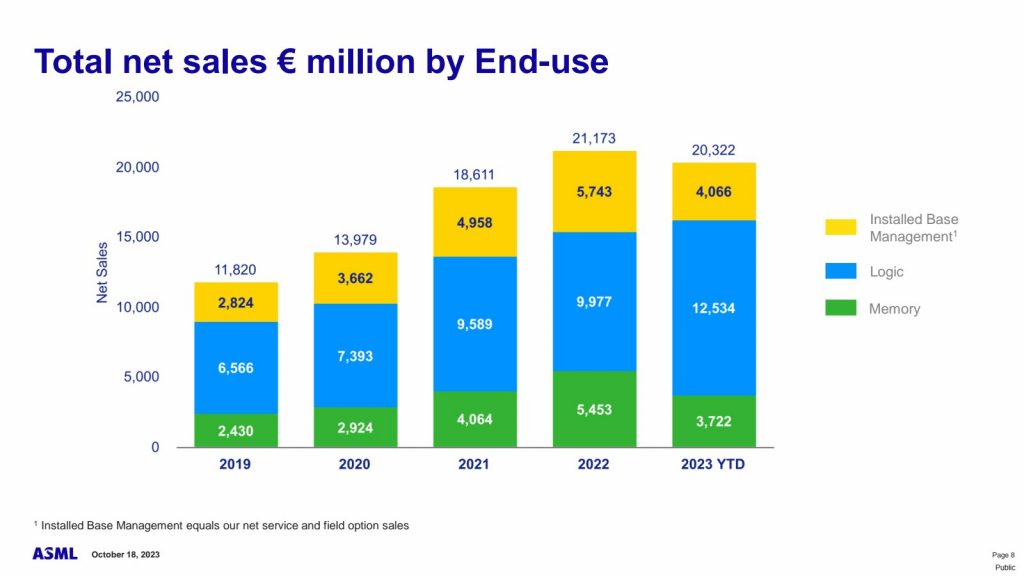

Net Sales +15%

*Lithography systems +30%

EBIT +13%

*Margin 32.7% (33.5)

Net Income +11%

*Margin 28.4% (29.4)

EPS +12% FCF -23%

Industry Cycle Bottom? “The semiconductor industry is currently working through the bottom of the cycle and our customers expect the inflection point to be visible by the end of this year” – CEO, Peter Wennink

Two-Year Outlook “Based on our current perspective, we take a more conservative view [on 2024] and expect a revenue number similar to 2023. But we also look at 2024 as an important year to prepare for significant growth that we expect for 2025.” – CEO, Peter Wennink