what3words is currently raising funding via crowdfunder – Crowdcube. I have always found What3words quite an interesting concept, so I thought I would dig into their numbers.

On the crowdcube pitch – it states – Over £100M in all-time funding – https://www.crowdcube.com/companies/what3words-2/pitches/lz91xq.

Why is what3words crowdfunding for a target of £1m when they have received over £100m though the company life – marketing purposes only ???

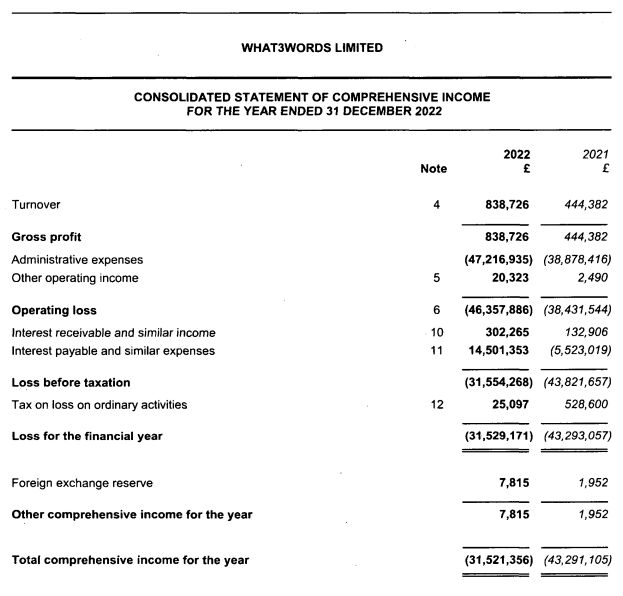

Attached is their P&L for 2022. While they have nearly doubled revenues from 2021 to 2022 – it still seems a giant world away from where they need to be to have raised over £100m in funding. They need to over 10x their current revenues to even get to a breakeven on the current valuation size.

Its going to be very interesting to see if this is possible and if it really solves a giant real world problem!