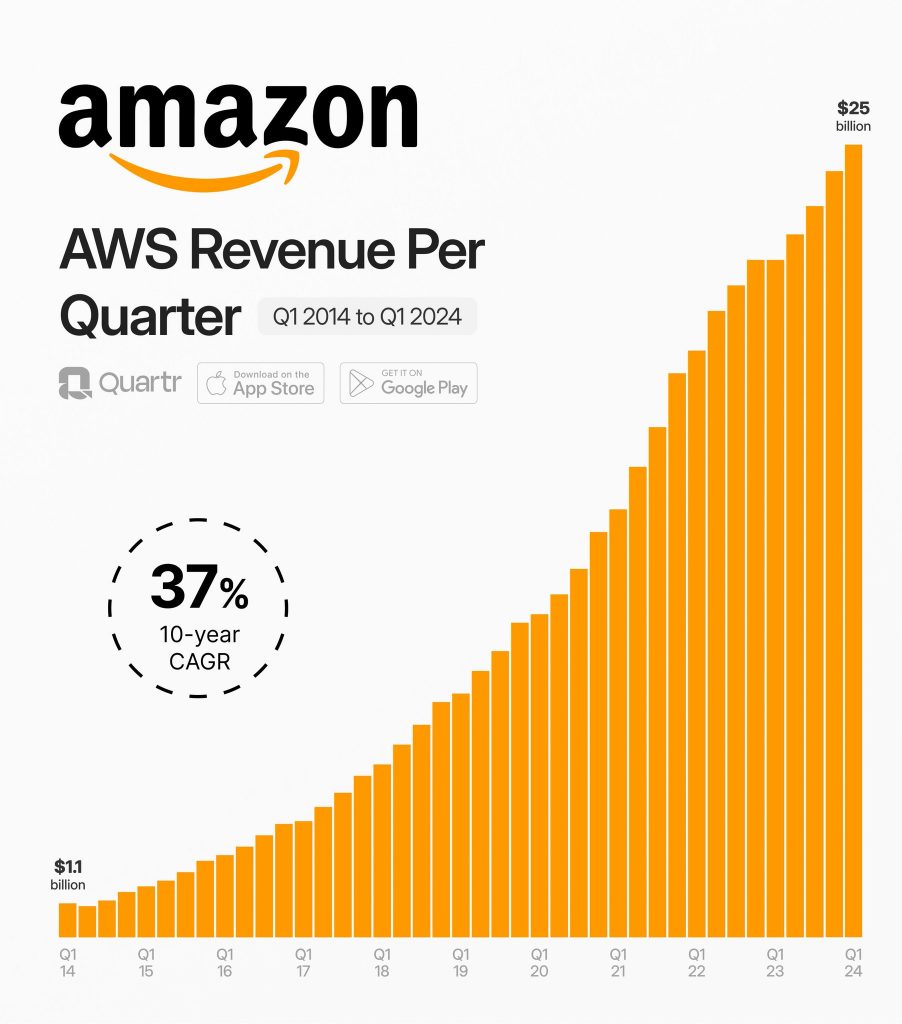

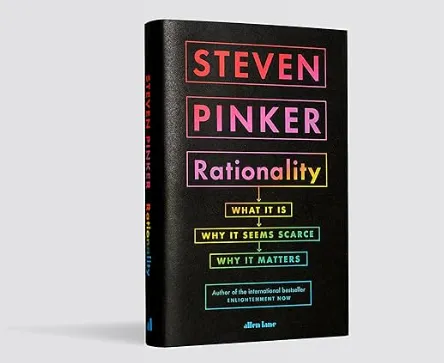

Revenue +13%

*Online Stores +7%

*Physical Stores +6%

*Third Party Sellers +16%

*Subscriptions +11%

*Advertising +24%

*AWS +17%

EBIT +221%

*marg. 10.7% (3.7)

EPS +219%

FCF LTM $50.1B (-3.3)

Tech, Business, Finance and Everything Else

Revenue +13%

*Online Stores +7%

*Physical Stores +6%

*Third Party Sellers +16%

*Subscriptions +11%

*Advertising +24%

*AWS +17%

EBIT +221%

*marg. 10.7% (3.7)

EPS +219%

FCF LTM $50.1B (-3.3)

90% of VCs add no value to startups, 70% even harm them.

Just the fact that you got an MBA and joined a venture fund doesn’t mean you can give useful advice to an entrepreneur

If you never built an actual business, you’re not qualified to give advice.

Vinod Khosla is the lead of Khosla Ventures and has invested in some of the worlds largest companies when they were young and in venture capital mode.

Here is the full interview:

Prince Albert II of Monaco, a tiny country renowned for its casinos, grand prix, and status as a tax haven, is facing scrutiny for allegedly favouring his nephews’ business interests. A yearlong investigation by Bloomberg revealed that his nephews’ construction company secured state contracts worth over $60 million. Furthermore, Prince Albert II allegedly helped quash a lawsuit from a competing developer over an apartment building his nephews aimed to develop near the Casino de Monte-Carlo. Government offices have been raided by the police, but the prince and his family deny any wrongdoing. Monaco remains one of the few countries where power is still centered in the palace. This has raised concerns among European officials, who fear that the wealthy nation “continues to serve as a back door to Western Europe for financial criminals,” as stated by Bloomberg.

The News: Online brokerage Webull is planning to go public via a $7.3 billion merger with a special purpose acquisition company (SPAC), after previous initial public offering (IPO) attempts were unsuccessful, partly due to its past crypto offerings.

Details: The New York-based company, which launched its trading platform in the U.S. in 2018, has agreed to merge with SK Growth Opportunities Corp. The company plans to start trading on the Nasdaq in the second half of 2024, giving Webull an estimated enterprise value of roughly $7.3 billion.

Webull’s U.S. CEO, Anthony Denier, stated that the company’s previous attempts to IPO were hindered by its cryptocurrency trading offerings, a practice the SEC has frowned upon. To eliminate this regulatory uncertainty and clear the path for its public listing, Webull sold its crypto asset business in late 2023.

Why SPAC?: Denier explained that the SPAC route provides a more certain valuation upfront compared to a traditional IPO. The blank-check deal is expected to raise approximately $100 million for Webull, which it intends to use for international expansion and new product development.

Webull experienced significant growth during the pandemic, with registered users reaching 20 million worldwide. The company has targeted more active traders than competitors like Robinhood, offering tools for technical analysis.

It’s important to note that this impending public listing occurs as fintechs proceed cautiously due to increased regulatory scrutiny of companies with ties to China. Despite early backing from Chinese tech giants Xiaomi and Alibaba, Denier emphasized that Webull is not majority-owned by Chinese entities.

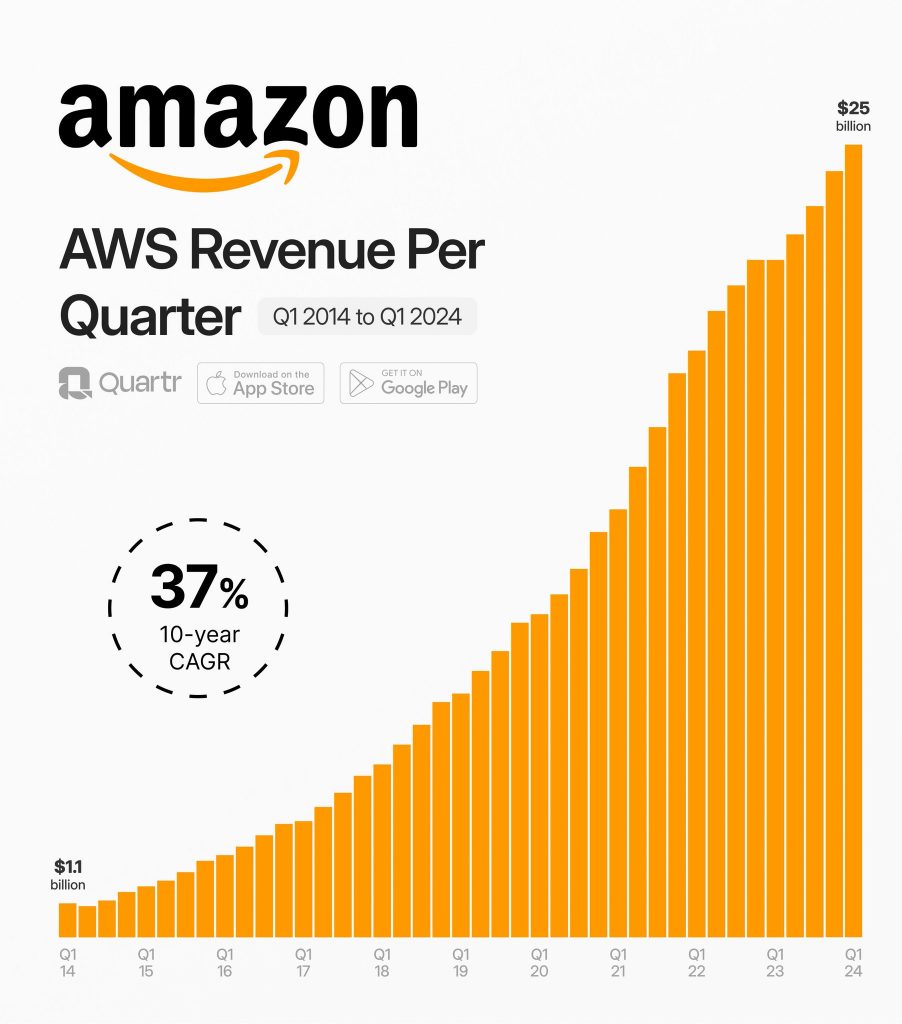

Great chart that outlines $O Realty Income’s dividend history.

Uninterrupted Dividend Streak of 54 years.

Investors seeking reliable income and potential capital appreciation often turn to dividend-paying funds. Fidelity Investments, a renowned financial services company, offers a range of funds that provide regular dividend payouts. Here’s a step-by-step guide on how to find Fidelity funds with dividends:

Remember, investing in dividend-paying funds involves risks, including the potential for fluctuations in market value and changes in dividend payments. Conduct thorough research and consider your own investment objectives before making any investment decisions.

Fidelity offers a wide range of funds with dividends, catering to varying investment preferences and risk appetites. By following the steps outlined above, you can find Fidelity funds that align with your investment goals and provide a steady stream of income through dividends.

Here are 5 MUST-read Books on Psychology and Decision-Making:

1. Rationality by Steven Pinker

2. Psychology and the Stock Market by David Dreman

A classic from 1977. One of the first books to explain the relationship between psychology and investing.

3. Thinking, Fast and Slow by Daniel Kahneman

The bible of human decision-making covering all sorts of Biases, Heuristics, and Decision-Making Flaws.

4. The Art of Thinking Clearly by Ralf Dobelli

We lose track of the essential things and focus on unimportant shiny news all the time. Learn how to avoid that.

5. Think Again by Adam Grant

You’ll make mistakes in investing. It’s important to recognise them early. This book teaches you how to pursue reconsideration and question your existing beliefs.

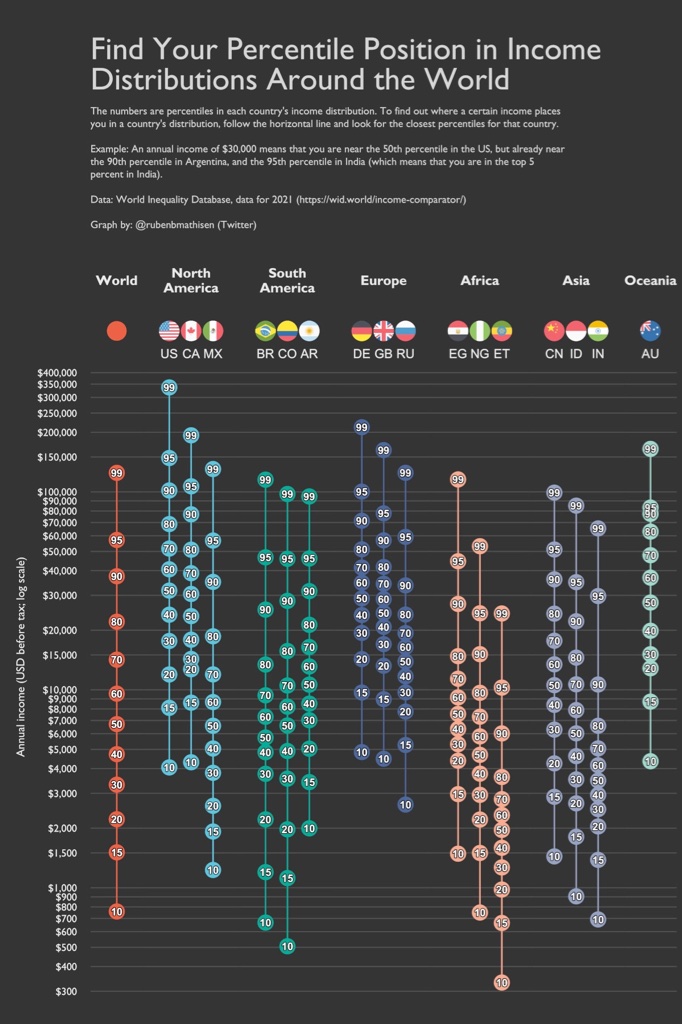

I came across this amazing graph that outlines different countries and their income distributions.

I have always thought I wasn’t doing very well compared with my peers, but turns out that is completely wrong!

Spotify’s A class and B class shares differ in two key ways:

Other than these two differences, Class A and Class B shares have the same rights and obligations. This means that they receive the same dividends and have the same right to participate in any liquidations or distributions.

The CEO of MongoDB, Dev Ittycheria, owns 218,085 shares of MongoDB stock. As of July 27, 2023, these shares are worth approximately $89 million. This represents about 0.22% of the company’s outstanding shares.

Ittycheria has been the CEO of MongoDB since 2014. He is also a director of Datadog Inc. and athenahealth Inc. His total yearly compensation is $13.23 million, comprised of 3% salary and 97% bonuses, including company stock and options.

Ittycheria’s ownership of MongoDB stock has increased significantly in recent years. In 2014, he owned just 16,000 shares of the company. However, he has since exercised stock options and purchased additional shares on the open market.

Ittycheria’s ownership of MongoDB stock gives him a significant financial stake in the company’s success. It also gives him a strong voice in the company’s strategic direction.

WeChat Pay, the popular mobile payment app in China, has announced that it will now accept foreign credit cards for payment in China. This is a major development for WeChat Pay, as it will make it easier for foreign tourists and businesses to use the app in China.

To use WeChat Pay with a foreign credit card, users will need to add their card to their WeChat Pay account. They can do this by going to the “Wallet” tab in WeChat and clicking on the “Add Credit Card” button. Once they have added their card, they will be able to use it to make payments at any merchant that accepts WeChat Pay.

WeChat Pay’s decision to accept foreign credit cards is a sign of the company’s growing global ambitions. The app is already popular in China, but it is also looking to expand its reach to other countries. Accepting foreign credit cards will make it easier for WeChat Pay to attract users outside of China.

Costco Wholesale Corporation, commonly known as Costco, is one of the largest retail giants in the world. It operates a chain of membership-only warehouse clubs and is known for its low prices on a wide range of products. While Costco is a publicly traded company, it is always interesting to know how much cash it has on hand.

According to its financial reports, as of the end of the fiscal year 2020, Costco had a total cash and cash equivalents of approximately $8.2 billion. This is a significant increase from the previous year when it reported $4.9 billion in cash and cash equivalents.

Costco’s healthy cash position can be attributed to its strong financial performance and its ability to generate cash flows from its operations. In the fiscal year 2020, Costco reported a net income of $4 billion, an increase of 9.7% compared to the previous year.

It is also worth noting that Costco has a history of returning value to its shareholders through dividends and share buybacks. In the fiscal year 2020, the company returned approximately $3.6 billion to its shareholders in the form of dividends and share buybacks.

In conclusion, Costco is a financially healthy company with a strong cash position. Its ability to generate cash flows from its operations and return value to shareholders makes it a desirable investment for many investors.

Wise.com (formerly known as TransferWise) is an online money transfer platform that has become increasingly popular in recent years. One of the reasons for its popularity is its low fees, which have made it an attractive option for people looking to send money abroad.

However, with the recent changes to the fees structure, it’s important for users to be aware of the current fees before making any transactions. Here’s an overview of the current Wise.com fees in the UK:

Wise.com charges a transfer fee, which is based on the amount you are sending and the currency you are sending it in. The fee is usually a percentage of the total amount being sent and can range from 0.35% to 2% of the total amount.

Wise.com uses the mid-market exchange rate, which is the rate that banks use when trading currencies with each other. This means that the exchange rate you get is usually better than what you would get from a bank or other money transfer service.

In addition to the transfer fee, Wise.com may also charge additional fees for certain transactions. For example, if you are sending money to a bank account that is not in your name, you may be charged an additional fee. Similarly, if you are sending money to certain countries, you may be charged an extra fee due to local regulations.

Overall, Wise.com fees are still relatively low compared to traditional banks and other money transfer services. However, it’s important to be aware of the current fees before making any transactions. By doing so, you can ensure that you are getting the best deal possible and avoiding any unnecessary fees.

Amazing Peter Lynch interview on Charlie Rose in 2013.

Peter Lynch is a legendary investor – who makes investing seem very ease with simple and affect methods.

Morningstar is an American financial services firm. It provides an array of investment research and investment management services. You can take a look at a company’s financials, valuation, operating performance, dividend, ownership and much more.

This site allows you to track the portfolios of the best investors in the world. Think about Warren Buffett and Terry Smith. You can also take a look at which stocks are bought the most by these superinvestors, which insiders are buying their own stocks.

Yahoo Finance provides you with financial news, data and commentary including stock quotes, press releases, financial reports, and original content. It’s a great website to check daily stock news or create a watchlist.

If you are looking for stock analysis, Seeking Alpha is the place to be. You can follow the stocks you want and you’ll receive an email each time someone publishes an article about the companies you’re interested in.

You can follow the stocks you want and you’ll receive an email each time someone publishes an article about the companies you’re interested in.

If you want to learn about a certain investment topic, Investopedia is the place to be. It features articles, tutorials, videos, and other content designed to help individuals make informed financial decisions.

It features articles, tutorials, videos, and other content designed to help individuals make informed financial decisions.

A lot of people are talking about Banks at present with the recent collapse of Silicon Valley Bank and others.

The banking sector is always an interesting topic and they are actually very interesting businesses.

They are in the business of using other people’s money to generate more money and try to add value through different services. If everyone takes their money out of a bank all at the same time – then all the banks in the world don’t have enough reserves to cover this.

However, with the death of the local branch – it seems now there is a growing opportunity for banks to slim down their staffing requirements, capital expenditures and simply products and services to focus on value driven opportunities.

It will be interesting in the coming months if there are any more banking collapses, but its an industry that is going to be heavily upset by the new online only banks focused on a much wider variety of services – at a fraction of the high street bank prices.

Great interview with Bill Ackman about why you should care more about Free Cash Flows than anything else.

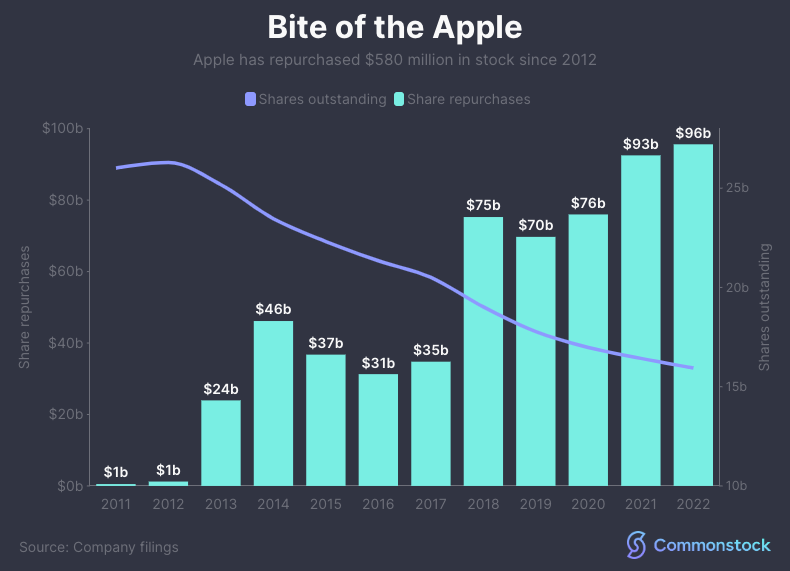

Since 2012, when Apple’s share count peaked, the company have repurchased more than $580 billion in stock.

That’s ~38% of the outstanding share count in ten years.

Even if the revenues remained flat the share price would increase and you would be far better off purely for holding.

Warren Buffett and Berkshire Hathaway hold a huge number of Apple stock – they must be laughing!

Free cash flow (FCF) is a financial metric that measures a company’s ability to generate cash after accounting for capital expenditures. It is an important indicator of a company’s financial health and ability to pay dividends, make acquisitions, and invest in growth opportunities.

FCF is calculated by taking a company’s operating cash flow (OCF) and subtracting capital expenditures (CapEx). OCF is the cash generated from a company’s operations, while CapEx is the cash spent on investments in property, plant, and equipment (PPE).

For example, if a company has an OCF of $100 million and CapEx of $50 million, its FCF would be $50 million. This means the company has $50 million in cash left over after accounting for investments in PPE.

A positive FCF is considered to be a good sign, as it means a company is generating more cash than it’s using in its operations. It also indicates that a company has a strong financial position and is able to pay dividends, make acquisitions, and invest in growth opportunities. On the other hand, a negative FCF is considered to be a red flag, as it means a company is using more cash than it’s generating, and it may indicate financial difficulties.

It’s important to note that FCF is different from net income, which is a measure of a company’s profitability. Net income takes into account a variety of factors such as revenue, expenses, and taxes, while FCF only measures cash flow. Additionally, FCF can also be affected by a company’s accounting methods and may not always reflect the true cash position of the company.

In summary, Free Cash Flow (FCF) is a financial metric that measures a company’s ability to generate cash after accounting for capital expenditures. It is an important indicator of a company’s financial health and ability to pay dividends, make acquisitions, and invest in growth opportunities. Positive FCF is considered to be a good sign, while negative FCF is considered to be a red flag, it’s important to consider it along with other financial metrics and market conditions.

Snowflake is a cloud-based data warehousing company that allows businesses to store, analyze, and share data in real-time. The company’s platform is built on top of the cloud infrastructure provided by Amazon Web Services, Microsoft Azure, and Google Cloud Platform. Snowflake is publicly traded on the New York Stock Exchange under the ticker symbol SNOW.

One important metric for evaluating a company’s financial health is free cash flow (FCF), which is the amount of cash a company generates after accounting for capital expenditures. FCF is important because it shows a company’s ability to generate cash and pay dividends or make acquisitions.

Snowflake has a positive free cash flow position, meaning that it generates more cash than it uses in its operations. In the most recent quarter, Snowflake reported a FCF of $56.6 million, up from $20.2 million in the same quarter last year. This represents a 180% year-over-year growth in FCF.

This strong FCF position has allowed Snowflake to invest in growth initiatives, including expanding its sales and marketing efforts and research and development. The company has also been able to return cash to shareholders through share buybacks.

Snowflake’s financial position has been supported by its subscription-based business model, which provides a steady stream of recurring revenue, and the growing demand for cloud-based data warehousing solutions. The company has also benefited from the shift to remote work and digital transformation as more companies turn to Snowflake’s cloud-based data warehousing solutions.