This pretty much sums up his whole approach in about a 1 minute video.

Tag: investing

Katie Haun – Launches Haun Ventures with $1.5 billion in Capital to Invest in Crypto Startups

Katie Haun (who was previously at a16z as the head of their crypto investments division) has started her own venture firm focused on the crypto market and has raised $1.5 billion.

The capital, the largest ever for a solo female founder-led venture, is split across two funds, with the first $500M tranche set out for backing early-stage startups. The remaining $1B “accelerator” fund will focus on late-stage well-established firms across Web3.

OpenSea Launches OpenSea Ventures – Investing in Startups around the NFT Ecosystem

Opensea have just announced their own Venture fund, Opensea Ventures. The fund will seek investments in startups working in domains such as NFTs, DeFi, blockchain, and others. OpenSea co-founder Alex Attalah will lead the venture fund.

The fund will focus on startups that produce NFTs, create NFT protocols, produce blockchain and metaverse games, and develop NFT analytics.

This seems like a natural next step to build out an ecosystem fast and potentially tie down some assets for exclusive sale in the Opensea platform.

Why Warren Buffett Started a Partnership – not a Mutual Fund

Great little video about why Warren Buffett started a partnership and not a mutual fund. Its all about the terminology.

Telstra Ventures – Bullish on the Chinese Technology Sector and Private Companies in China

Even though there has been a huge crackdown in the Chinese Tech companies – it seems like there are still many Venture Capital firms that are bullish on the future of the Chinese Tech sector.

One venture firm that is looking for more opportunities is Telstra Ventures. Telstra Ventures is the venture capital arm of Telstra – Australia’s largest telecoms company.

Telstra has been investing in China for the past six years. It now counts three Chinese unicorns in its portfolio.

Keep an eye on Telstra Ventures investments as it seems like their research is finding some of the best opportunities in the Chinese Tech sector.

Warren Buffett: How To Achieve A 30% Return Per Year Investing (7 Investing Rules)

Here is a great video on some of Warren Buffett’s very simple ideas and principles. It doesn’t elaborate on some of the key points, but it’s a great starting point.

Mohnish Pabrai and his 6 Investing Rules

Mohnish Pabrai is often called the Indian Warren Buffett. Here is a video that outlines his 6 tips for investing returns of over 25% per year.

VCs More Worried About Their Socials

Is it just me or do VCs spend more time tweeting these days compared to actual research in the markets they are going to invest in?

Garry Tan Interview on Everything Angel Investing

Great interview with Garry Tan about all things investing – including the recent move by Alexis Ohanian to leave Initialized.

Can I Open a Webull Account in the UK?

Currently – No.

Webull is currently only available in the US, Brazil, Japan, and India and is yet to go live in the UK.

However, it is only a matter of time before it makes its way to the UK.

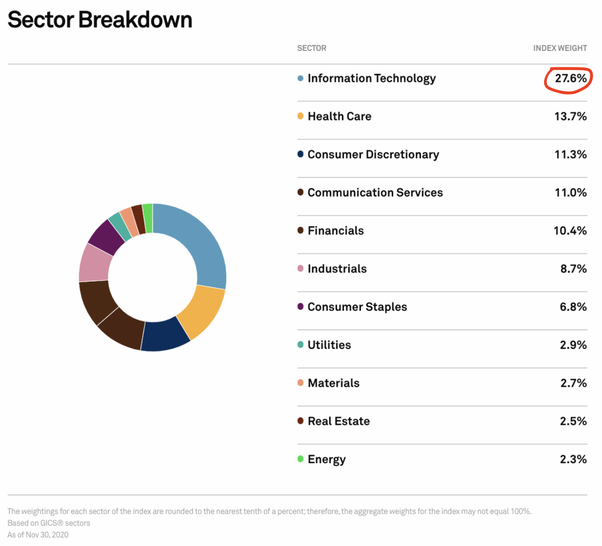

Is the S&P 500 Over Weighted in Tech Stocks or Not?

The S&P 500 is an index of some of the leading companies in the United States. The S&P 500 doesn’t push extremely high in one area as its supposed to show a cross section of America.

Here is the breakdown the S&P 500 by Market Sector:

As you can see there is a very broad cross section of companies in all sectors of America. Technology is the leading sector, but it’s not the whole S&P 500.

Warren Buffett: Amazon’s Jeff Bezos Has Changed The World

Warren Buffett’s views on Jeff Bezos and how he has changed the world.

Why this matters: Warren Buffett for a long time has been watching Jeff Bezos and commenting on how amazing the run of Amazon has been. It would have been very interesting if Warren Buffett understood the technology industry at the beginning of the internet as it would have provided a lot of great investment opportunities.

Bill Ackman: Amazing 1 Hour Interview with Pershing Square Founder, hedge funds & learning from your mistakes (Video)

Bill Ackman is a very interesting person in the world of investing. Below is a great interview with Bill that talks about everything Pershing Square, hedge funds and learning from your mistakes. There are a lot of great quotes inside this interview.

WMG – Warner Music Group Starts Selling Shares on the NASDAQ Today

Warner Music Group is going live on the NASDAQ today. Warner are offering 77 million class A shares at $25 a share. If Warner opens up at $25 per share that means they will have a $12.8 billion valuation.

It’s going to be very interesting to see if investors have an appetite for music companies again.

Underwriters for the new offering include Morgan Stanley, Credit Suisse, and Goldman Sachs. Ticker symbol will be WMG.

Warner Music Group has an amazing catalogue, but I’m very keen to learn more about their recent investments and what other industries they think they can enter, because doing the old record label model just isn’t going to gain enough growth over the next 20 years.

Bill Ackman: Free Cashflow is Everything and The Main Way To Value a Company

Bill Ackman is an investor that many people across the world follow. Here is an interested snippet from an interview with Bill (not sure the date), but it provides an idea on what type of companies Bill really wants to invest in.