Its pretty amazing to see. Revolut ads are starting to take over an airport near you. These positions used to be controlled by HSBC, but it really does feel like the world is changing in banking – and we are finally getting a good product.

Tech, Business, Finance and Everything Else

Its pretty amazing to see. Revolut ads are starting to take over an airport near you. These positions used to be controlled by HSBC, but it really does feel like the world is changing in banking – and we are finally getting a good product.

This is the key reason media companies don’t stand the test of time!

This is Digital Music News. There are barely two paragraphs on the page and the vast majority of the page is just spammed full of advertising!

It’s impossible to even read the article!!!!!!

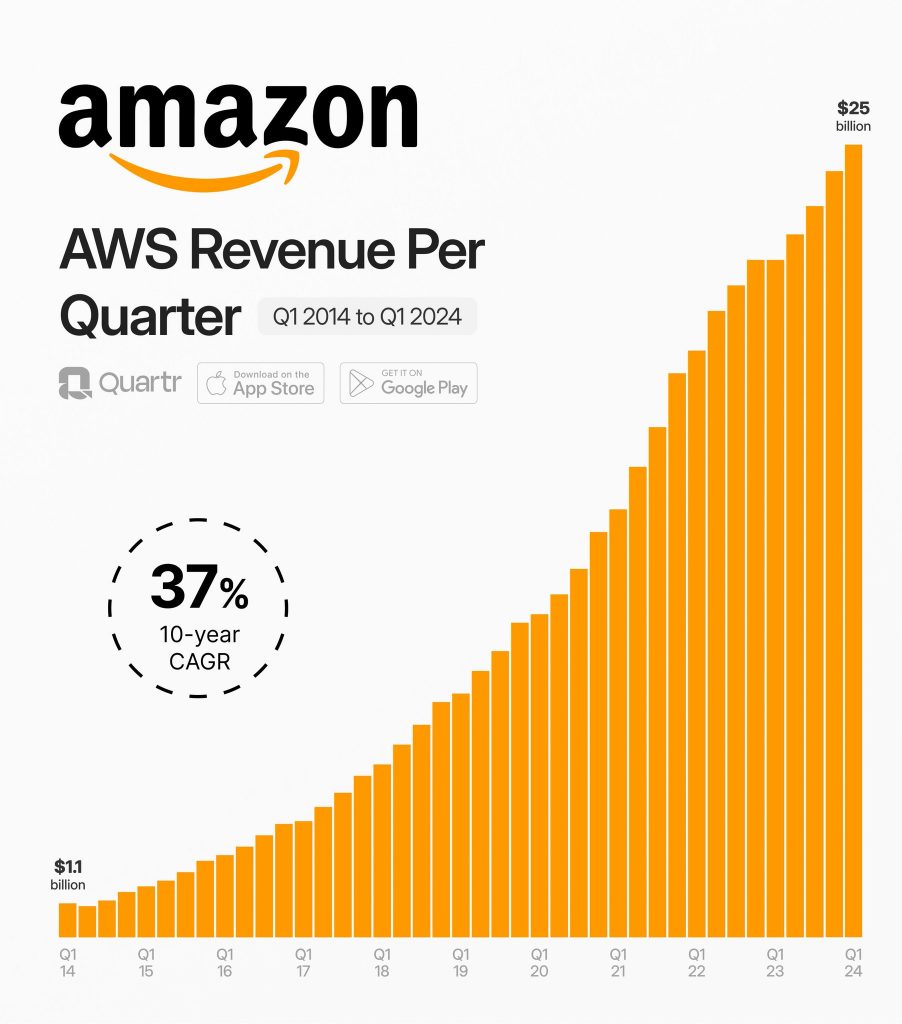

Revenue +13%

*Online Stores +7%

*Physical Stores +6%

*Third Party Sellers +16%

*Subscriptions +11%

*Advertising +24%

*AWS +17%

EBIT +221%

*marg. 10.7% (3.7)

EPS +219%

FCF LTM $50.1B (-3.3)

A lot of people have been giving Google a really hard time of late over their troubled entry into AI – with their chat interface Gemini. Additionally, there are investors out there that think OpenAI, Perplexity and others will start to disrupt their search business which is their main revenue stream via ads.

I don’t think this is going to happen and here is my take:

I think I will be buying more for my own investment portfolio.

Business Insider is a popular business news website, but it is also notorious for its excessive advertising. The site is cluttered with ads, making it difficult to read and navigate.

There are a number of reasons why Business Insider has so much advertising. First, the site is free to use, and advertising is its primary source of revenue. Second, Business Insider’s target audience is businesses, which are willing to pay a premium for advertising on a site that reaches a large number of decision-makers.

However, the amount of advertising on Business Insider is so high that it actually detracts from the user experience. The ads are often intrusive and distracting, and they can make it difficult to find the information you are looking for.

Here are a few specific examples of how Business Insider’s advertising overload can make the site difficult to read:

Overall, Business Insider’s advertising overload makes the site difficult to read and navigate. The ads are often intrusive and distracting, and they can make it difficult to find the information you are looking for.

YouTube’s advertising revenues grew by 12.5% year-on-year in Q3 2023, according to parent company Alphabet. This growth comes after a period of decline, and is a sign that YouTube is still a major player in the online advertising market.

One of the key drivers of YouTube’s ad revenue growth is the rise of YouTube Shorts. YouTube Shorts are short-form videos that are up to 60 seconds long. They were launched in 2020, and have quickly become one of the most popular features on YouTube.

YouTube Shorts are popular with advertisers because they are a highly engaging format. They are also a good way to reach younger viewers, who are increasingly spending their time on mobile devices.

In addition to YouTube Shorts, YouTube is also investing in other ways to make its platform more attractive to advertisers. For example, YouTube is developing new ad formats, and is making it easier for advertisers to measure the effectiveness of their campaigns.

YouTube’s ad revenue growth is good news for both YouTube and its creators. YouTube creators rely on ad revenue to make a living, so the more ad revenue that YouTube generates, the more money that creators can earn.

Overall, YouTube’s ad revenue growth in Q3 2023 is a positive sign for the platform. It shows that YouTube is still a major player in the online advertising market, and that it is investing in ways to make its platform more attractive to advertisers.

Elon Musk said on Saturday that Twitter’s cash flow remains negative, due to a nearly 50% drop in advertising revenue and a heavy debt load. Musk had previously said that he expected Twitter to reach cash flow positive by June.

“We’re still negative cash flow, due to ~50% drop in advertising revenue plus heavy debt load,” Musk said in a tweet. “Need to reach positive cash flow before we have the luxury of anything else.”

Twitter’s advertising revenue has been declining for several quarters. In the first quarter of 2023, advertising revenue fell 19% year-over-year. The decline in advertising revenue is likely due to a number of factors, including the ongoing war in Ukraine, rising inflation, and the increasing popularity of other social media platforms.

Twitter’s debt load is also a major concern. The company has about $13 billion in debt, which it used to finance Musk’s acquisition of the company. Musk has said that he plans to reduce Twitter’s debt load, but it is unclear how he plans to do so.

The combination of negative cash flow and a heavy debt load puts Twitter in a precarious financial position. If Twitter is unable to turn things around, it could be forced to sell itself or file for bankruptcy.

What does this mean for Twitter’s future?

The news that Twitter’s cash flow remains negative is a major setback for the company. It is unclear how Twitter will be able to turn things around, and there is a real risk that the company could be forced to sell itself or file for bankruptcy.

Musk has said that he is committed to turning Twitter around, but it is unclear how he plans to do so. He has proposed a number of changes, including reducing the company’s debt load, making the platform more user-friendly, and cracking down on spam and bots.

However, it is not clear if these changes will be enough to save Twitter. The company is facing a number of challenges, including the decline in advertising revenue, the increasing popularity of other social media platforms, and the ongoing war in Ukraine.

It is too early to say what the future holds for Twitter. However, the news that the company’s cash flow remains negative is a major setback, and it is clear that Twitter is facing some serious challenges.

I have recently added Adsense to Crenk.

I wondered how long it takes before the ad code starts to show correctly on your site once it has been added.

Answer = random.

If your using the same Google account or the same IP address as you did when you inserted the code then Google won’t show you an ads and you will see a big white blank space.

However, if you get in touch with a friend and get them to test the site for you then they should be able to generally see the ads. It normally takes a few hours after the ad has been inserted, but sometimes it can be faster.

It was confirmed that Spotify is buying Megaphone for $235 million.

Megaphone is a podcasting hosting and advertising company – it’s easy to see how this fits into Spotify’s plans for world domination in the podcast market, but it will throw up a lot of concerns on how powerful Spotify is in this market now and how they plan to control all the data around podcasts.

These podcasts should be platform agnostic – like music. However, they seem to be getting acquired and then made exclusive for either Spotify, Apple Music, Deezer, Tidal or whoever has the most money at the time.

Who is going to lose out? CONSUMERS!

Podcasts are completely free on Spotify at the moment. Thus, Spotify won’t pay you any royalties no matter how many times your podcast is played or downloaded.

How Do I Make Money on Podcasts?

Advertising / Sponsors is the main way to monetize a podcast at present. You will need to create a podcast with listeners and then go out and find Sponsors.

Yes.

YouTube have recently changed their rules for YouTube MCN’s which means that all channels within the MCN’s need to be part of the YouTube Partner Program before they become eligible to be added to the MCN’s.

YouTube have been frequently changing the rules for MCN’s which is leaving a lot of channels up against it.