Amazing Peter Lynch interview on Charlie Rose in 2013.

Peter Lynch is a legendary investor – who makes investing seem very ease with simple and affect methods.

Tech, Business, Finance and Everything Else

Amazing Peter Lynch interview on Charlie Rose in 2013.

Peter Lynch is a legendary investor – who makes investing seem very ease with simple and affect methods.

Morningstar is an American financial services firm. It provides an array of investment research and investment management services. You can take a look at a company’s financials, valuation, operating performance, dividend, ownership and much more.

This site allows you to track the portfolios of the best investors in the world. Think about Warren Buffett and Terry Smith. You can also take a look at which stocks are bought the most by these superinvestors, which insiders are buying their own stocks.

Yahoo Finance provides you with financial news, data and commentary including stock quotes, press releases, financial reports, and original content. It’s a great website to check daily stock news or create a watchlist.

If you are looking for stock analysis, Seeking Alpha is the place to be. You can follow the stocks you want and you’ll receive an email each time someone publishes an article about the companies you’re interested in.

You can follow the stocks you want and you’ll receive an email each time someone publishes an article about the companies you’re interested in.

If you want to learn about a certain investment topic, Investopedia is the place to be. It features articles, tutorials, videos, and other content designed to help individuals make informed financial decisions.

It features articles, tutorials, videos, and other content designed to help individuals make informed financial decisions.

This morning we posted about Believe Digital acquiring Sentric Music Publishing.

I wanted to provide a little more context about the acquisition.

Sentric – Companies House accounts – https://find-and-update.company-information.service.gov.uk/company/05721428/filing-history

2021 Year End Numbers:

Acquisition price was $51 million.

It feels like this was a good price on both counts. Utopia obviously sold Sentric at a discount, but they really need to get rid of the asset (they only purchased a year ago). Believe got a good asset in a new market – at a reasonable multiple.

Believe Digital has acquired music publishing company Sentric for $51 million from Utopia Music.

This is a great move from Believe – and as Utopia have been in a lot of issues with debt recently – it feels like a bit of a fire sale.

“The acquisition of SENTRIC is the first step for BELIEVE in the roll-out of a global and comprehensive publishing offer. The growth and digital transformation of the songwriters’ market is opening-up many opportunities. We are excited to be able to immediately expand the services we provide to our existing TUNECORE clients with SENTRIC’s best-in-class royalty collection service, while starting to work on future innovative products and services for all of Believe’s songwriters and publishers.”

BELIEVE CEO DENIS LADEGAILLERIE said,

Believe is currently looking for more acquisitions – they normally focus around record labels, but this put Believe into a completely new market with a strong TAM.

A lot of people are talking about Banks at present with the recent collapse of Silicon Valley Bank and others.

The banking sector is always an interesting topic and they are actually very interesting businesses.

They are in the business of using other people’s money to generate more money and try to add value through different services. If everyone takes their money out of a bank all at the same time – then all the banks in the world don’t have enough reserves to cover this.

However, with the death of the local branch – it seems now there is a growing opportunity for banks to slim down their staffing requirements, capital expenditures and simply products and services to focus on value driven opportunities.

It will be interesting in the coming months if there are any more banking collapses, but its an industry that is going to be heavily upset by the new online only banks focused on a much wider variety of services – at a fraction of the high street bank prices.

Great interview with Bill Ackman about why you should care more about Free Cash Flows than anything else.

Duolingo is currently working on a music app.

It turns out that Duolingo (which has over 500 million users – not sure how many are active) – have been working on a music app with a small team for some time.

There is currently a job for a learning scientist who is an “expert in music education who combines both theoretical knowledge of relevant learning science research and hands-on teaching experience”.

The job listing suggests that the app will teach basic concepts in music theory using popular songs and teachers.

This sounds very interest – as it would be a great stepping stone for Duolingo to move into a lot of new and interesting areas of education, with their already massive audience.

via – Techcrunch

Deel is an amazing HR tool that focuses on global payroll and compliance systems.

In 2021 Deel had $50 million in ARR

In 2022 Deel has just announced they had $295 million in ARR (annual recurring revenue).

This also coincides with Deel announcing that they are now at a $12 billion valuation.

In this past 12 months Deel has announced the launch of Deel HR, US Payroll, and Deel Engage, applications for hiring, managing and paying global workers compliantly.

Deel is going to be a company to watch in the HR space for many years to come and if they are going to be acquired they really need be acquired within the next 24 months – otherwise they are going to be too big!

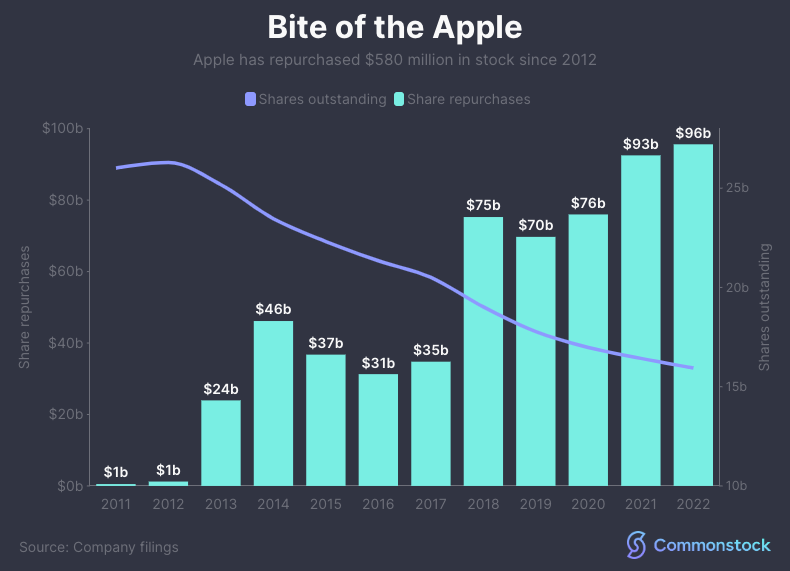

Since 2012, when Apple’s share count peaked, the company have repurchased more than $580 billion in stock.

That’s ~38% of the outstanding share count in ten years.

Even if the revenues remained flat the share price would increase and you would be far better off purely for holding.

Warren Buffett and Berkshire Hathaway hold a huge number of Apple stock – they must be laughing!

Anthony Pompliano is a very interesting investor who has learnt a huge amount about starting businesses from scratch and driving them up to be worth millions.

Here is a recent interview he did with the My First Million guys.

Free cash flow (FCF) is a financial metric that measures a company’s ability to generate cash after accounting for capital expenditures. It is an important indicator of a company’s financial health and ability to pay dividends, make acquisitions, and invest in growth opportunities.

FCF is calculated by taking a company’s operating cash flow (OCF) and subtracting capital expenditures (CapEx). OCF is the cash generated from a company’s operations, while CapEx is the cash spent on investments in property, plant, and equipment (PPE).

For example, if a company has an OCF of $100 million and CapEx of $50 million, its FCF would be $50 million. This means the company has $50 million in cash left over after accounting for investments in PPE.

A positive FCF is considered to be a good sign, as it means a company is generating more cash than it’s using in its operations. It also indicates that a company has a strong financial position and is able to pay dividends, make acquisitions, and invest in growth opportunities. On the other hand, a negative FCF is considered to be a red flag, as it means a company is using more cash than it’s generating, and it may indicate financial difficulties.

It’s important to note that FCF is different from net income, which is a measure of a company’s profitability. Net income takes into account a variety of factors such as revenue, expenses, and taxes, while FCF only measures cash flow. Additionally, FCF can also be affected by a company’s accounting methods and may not always reflect the true cash position of the company.

In summary, Free Cash Flow (FCF) is a financial metric that measures a company’s ability to generate cash after accounting for capital expenditures. It is an important indicator of a company’s financial health and ability to pay dividends, make acquisitions, and invest in growth opportunities. Positive FCF is considered to be a good sign, while negative FCF is considered to be a red flag, it’s important to consider it along with other financial metrics and market conditions.

Snowflake is a cloud-based data warehousing company that allows businesses to store, analyze, and share data in real-time. The company’s platform is built on top of the cloud infrastructure provided by Amazon Web Services, Microsoft Azure, and Google Cloud Platform. Snowflake is publicly traded on the New York Stock Exchange under the ticker symbol SNOW.

One important metric for evaluating a company’s financial health is free cash flow (FCF), which is the amount of cash a company generates after accounting for capital expenditures. FCF is important because it shows a company’s ability to generate cash and pay dividends or make acquisitions.

Snowflake has a positive free cash flow position, meaning that it generates more cash than it uses in its operations. In the most recent quarter, Snowflake reported a FCF of $56.6 million, up from $20.2 million in the same quarter last year. This represents a 180% year-over-year growth in FCF.

This strong FCF position has allowed Snowflake to invest in growth initiatives, including expanding its sales and marketing efforts and research and development. The company has also been able to return cash to shareholders through share buybacks.

Snowflake’s financial position has been supported by its subscription-based business model, which provides a steady stream of recurring revenue, and the growing demand for cloud-based data warehousing solutions. The company has also benefited from the shift to remote work and digital transformation as more companies turn to Snowflake’s cloud-based data warehousing solutions.

Veeva Systems is a cloud-based software company that specializes in providing solutions for the pharmaceutical and biotechnology industries. The company’s product portfolio includes solutions for customer relationship management, clinical trial management, and regulatory compliance. Veeva is publicly traded on the New York Stock Exchange under the ticker symbol VEEV.

One important metric for evaluating a company’s financial health is free cash flow (FCF), which is the amount of cash a company generates after accounting for capital expenditures. FCF is important because it shows a company’s ability to generate cash and pay dividends or make acquisitions.

Veeva Systems has a strong free cash flow position. In the most recent quarter, Veeva reported a FCF of $284.5 million, up from $221.1 million in the same quarter last year. This represents a 28.5% year-over-year growth in FCF.

This strong FCF position has allowed Veeva to make strategic acquisitions and return cash to shareholders through share buybacks and dividend payments. The company has also been able to invest in research and development and expand its product offerings.

Veeva’s financial position has been supported by its subscription-based business model, which provides a steady stream of recurring revenue. The company has also benefited from the growing demand for cloud-based solutions in the pharmaceutical and biotechnology industries.

Zoho is a privately held software development company that offers a wide range of products for businesses of all sizes. The company was founded in 1996 in India, and it has since grown to become a major player in the software industry.

One of the most notable aspects of Zoho is its extensive product portfolio, which includes solutions for various business functions such as customer relationship management, accounting, human resources, and more. Some of their popular products are CRM, Mail, Office Suite, Creator, and Books.

Zoho CRM, for example, is a comprehensive CRM solution that helps businesses manage their sales, marketing, and customer support activities. Zoho Mail, on the other hand, is a web-based email service that offers a range of features such as calendar, contacts, and tasks.

In addition to its diverse product offering, Zoho is also known for its commitment to customer service and support. The company offers a wide range of resources, including documentation, tutorials, and webinars, to help customers make the most of its products.

Despite its success, Zoho has no plans to go public. According to the CEO, Sridhar Vembu, the company is focused on building a sustainable business model, rather than chasing short-term gains. He believes that going public would pressure the company to focus on meeting quarterly earnings targets, rather than long-term growth.

However, it’s worth noting that this doesn’t mean that Zoho will never go public. The company could change its mind in the future if it feels that going public would be in the best interest of its shareholders.

Salesforce is a cloud-based customer relationship management (CRM) software company that has experienced significant growth in recent years. The company has a diverse range of products, including Sales Cloud, Service Cloud, Marketing Cloud, and more.

One important metric for evaluating a company’s financial health is free cash flow (FCF), which is the amount of cash a company generates after accounting for capital expenditures. FCF is important because it shows a company’s ability to generate cash and pay dividends or make acquisitions.

For Salesforce, the company’s FCF has been consistently positive in recent years, indicating a strong financial position. In the most recent quarter, Salesforce reported a FCF of $1.4 billion, up from $1.1 billion in the same quarter last year. This represents a 27% year-over-year growth in FCF.

This strong FCF position has allowed Salesforce to make strategic acquisitions, such as its $27.7 billion acquisition of Slack. The company also has a history of returning cash to shareholders through share buybacks and dividend payments.

In addition, Salesforce’s financial position has been supported by its subscription-based business model, which provides a steady stream of recurring revenue. The company has also benefited from the shift to remote work and digital transformation, as more companies turn to Salesforce’s cloud-based CRM solutions.

In summary, Salesforce’s strong free cash flow position has allowed the company to make strategic acquisitions and return cash to shareholders. The company’s subscription-based business model and the shift to remote work have also supported its financial position. This makes Salesforce an attractive option for investors looking for a company with a strong financial position.

For the fiscal year ended January 31, 2021, Salesforce reported a free cash flow of $5.05 billion. This represents an increase of 28% compared to the previous year. This is a strong indication of the company’s financial health and stability.

YouTube is reportedly in the process of negotiating with media companies to provide their TV shows and films as part of an ad-supported hub of channels. The platform is already in the process of testing viewer interest in this idea and could potentially roll out the hub to more users before the end of the year, according to The Wall Street Journal. This could be a significant opportunity for YouTube to expand its platform, as well as to increase its revenue from advertising. Furthermore, it would give media companies the chance to reach larger audiences and potentially create more engagement with their content. This hub of ad-supported channels could be a mutually beneficial venture, with YouTube and media companies reaping the rewards.

Streaming services like SoundCloud have opened up new opportunities for musicians to be heard around the world. But many people are curious about the financial side of streaming, specifically how much money do artists make per stream on SoundCloud? In this blog post, we’ll explore the answer to this question.

SoundCloud’s payment model is based on revenue sharing. Each time a user listens to a song on the platform, the artist earns a portion of the revenue generated by ads or subscriptions. The exact amount varies depending on the terms of the artist’s contract with SoundCloud, as well as the country where the song is being streamed.

The amount of money paid per stream on SoundCloud can range from $0.0017 to $0.0084, with the average being around $0.0031 per stream. However, the exact amount varies depending on the artist’s contract and the country where the song is being streamed.

The amount of money earned per stream on SoundCloud is affected by several factors, such as the artist’s contract with the platform and the country where the song is being streamed. Additionally, the type of user who is streaming the song can also affect the amount of money earned. For example, if a premium user is streaming the song, the artist may earn more money than if a free user was streaming the same song.

Streaming services like SoundCloud have opened up new opportunities for musicians to be heard around the world. But it’s important to understand the financial side of streaming, specifically how much money do artists make per stream on SoundCloud? The amount of money paid per stream on SoundCloud can range from $0.0017 to $0.0084, with the average being around $0.0031 per stream. However, the exact amount varies depending on the artist’s contract and the country where the song is being streamed, as well as other factors such as the type of user who is streaming the song.

Berkshire Hathaway is a holding company owned by Warren Buffett and is one of the most successful and well-known businesses in the world. The company has two classes of stock, A and B, and the two stocks have some important differences. In this post, we’ll explore the difference between the two types of stock and what that means for investors.

Berkshire Hathaway Class A shares are the company’s original stock, and are traded on the New York Stock Exchange under the ticker symbol BRK.A. Class A shares are the most expensive, currently trading around $350,000 per share. The stock is known for its high dividend yield, and investors receive one vote per share when voting at the company’s annual meeting.

Berkshire Hathaway’s Class B shares are much more affordable, trading around $250 per share. The stock still carries the ticker symbol BRK.B and still pays a dividend, though it is not as high as the Class A stock. In addition, Class B shares only carry one-tenth of the voting power of Class A shares.

Berkshire Hathaway A stock and B stock are two classes of stock offered by the company. Class A stock is the most expensive, but carries more voting power and a higher dividend yield. Class B stock is more affordable and pays a dividend, though it carries much less voting power. Both classes of stock offer investors a chance to benefit from the long-term success of Berkshire Hathaway.