Dividend investing can be considered better than standard long-term investing for capital growth returns due to several reasons:

- Regular Income: Dividend investing focuses on investing in companies that pay regular dividends to their shareholders. This provides investors with a consistent stream of income, which can be reinvested or used for other purposes.

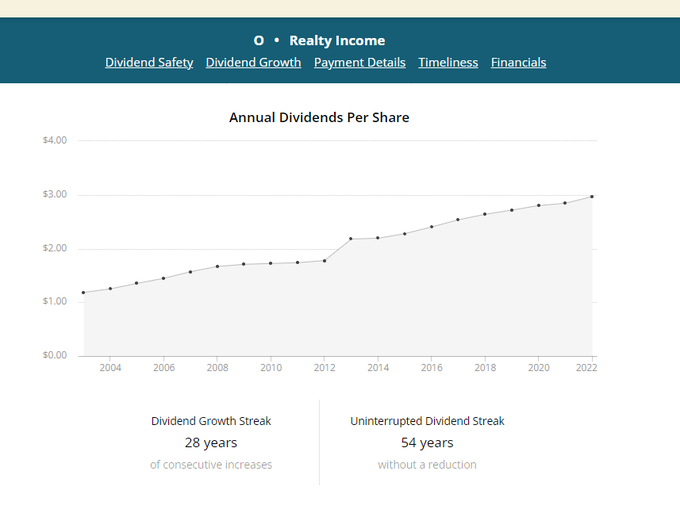

- Compounding Effect: Dividends can be reinvested to purchase additional shares of the company’s stock. Over time, this reinvestment can lead to the compounding effect, where the dividend income grows exponentially.

- Stability and Consistency: Companies that pay dividends are often mature and stable, with a track record of generating consistent profits. This stability can provide a level of confidence to investors, especially those seeking reliable income.

- Lower Market Volatility: Dividend-paying stocks tend to be less volatile compared to growth stocks. This lower volatility can provide a smoother investment experience, particularly for those who prefer a more conservative approach.

- Inflation Hedge: Dividends have the potential to increase over time, which can help investors keep up with inflation and maintain purchasing power.

It’s important to note that the choice between dividend investing and standard long-term investing depends on individual preferences, risk tolerance, and investment goals. Both approaches have their advantages and drawbacks, and it’s essential to consider one’s specific financial situation before making investment decisions.