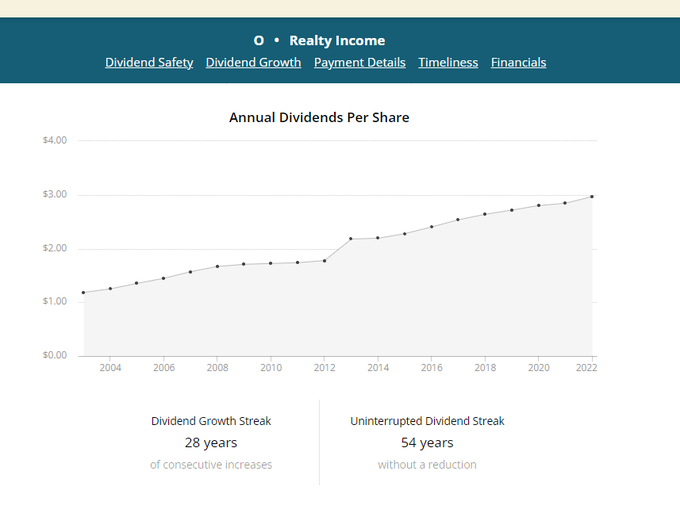

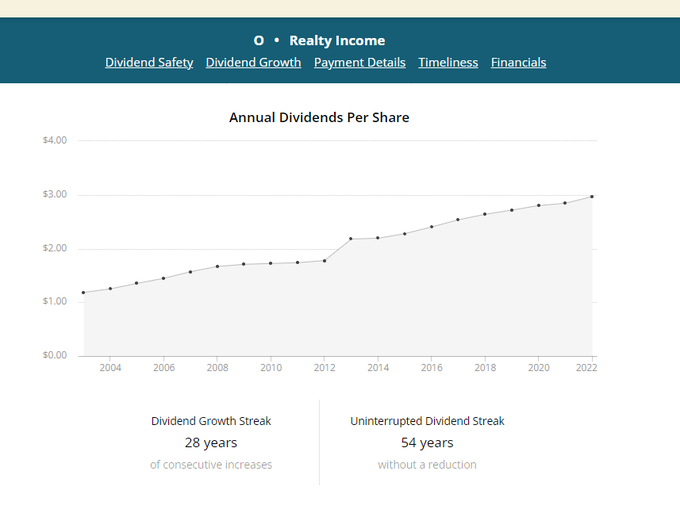

Great chart that outlines $O Realty Income’s dividend history.

Uninterrupted Dividend Streak of 54 years.

Tech, Business, Finance and Everything Else

Great chart that outlines $O Realty Income’s dividend history.

Uninterrupted Dividend Streak of 54 years.

PennyMac Mortgage Investment Trust (PMT), traded on the New York Stock Exchange as PMT, is a publicly traded real estate investment trust (REIT) in the United States. Here’s a breakdown of what they do:

What they invest in:

Their goal:

Key things to know about PMT:

Who might be interested in PMT:

NNN REIT, or National Retail Properties, Inc., is a real estate investment trust (REIT) that specializes in owning and operating single-tenant, net-lease retail properties. This means that the company owns retail properties where there is only one tenant occupying the building, and the tenant is responsible for all of the operating expenses, such as property taxes, insurance, and maintenance.

NNN REIT is one of the largest publicly traded REITs in the United States, with a portfolio of over 3,400 properties in 49 states. The company’s tenants include a wide range of national retailers, such as Walgreens, CVS, Chipotle, and Starbucks.

NNN REIT is a popular investment for investors who are looking for a steady stream of income. The company has a long history of dividend growth, and it has increased its dividend for 34 consecutive years. NNN REIT’s shares are also traded on the New York Stock Exchange, which makes them liquid and easy to sell.