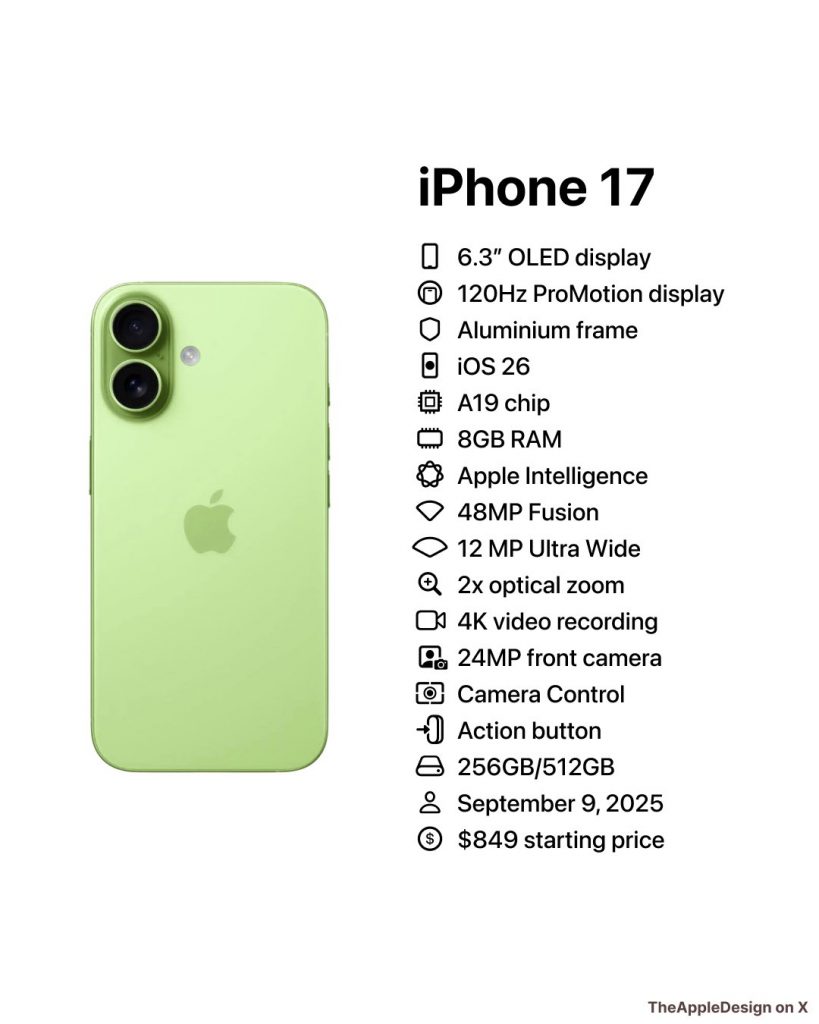

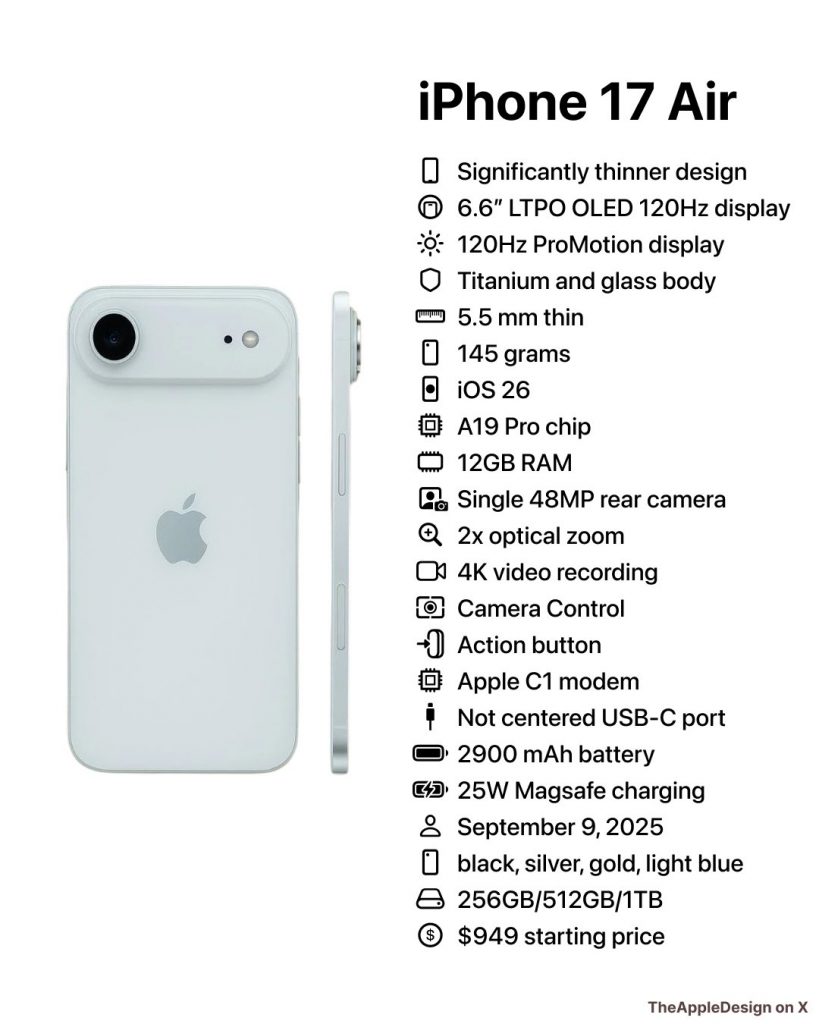

The next Apple event is getting closer and here is what to expect when they launch the iPhone 17 and iPhone 17 Air.

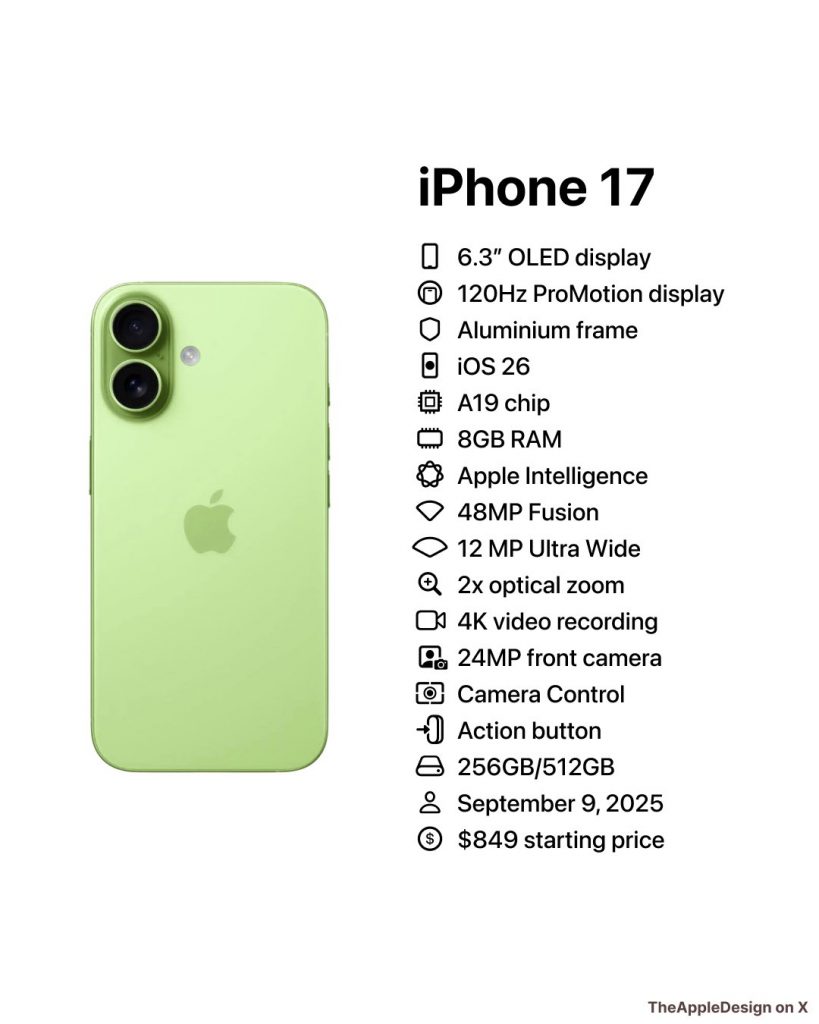

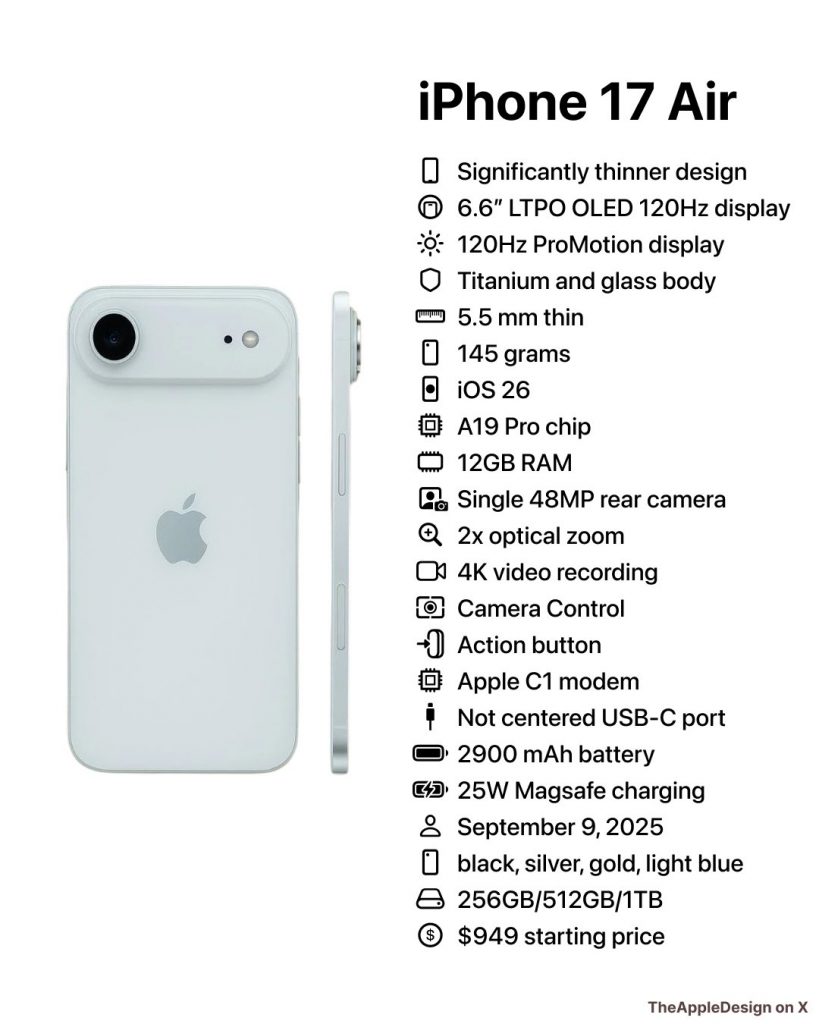

Which one of these iPhone 17 versions will you be looking to get?

Tech, Business, Finance and Everything Else

The next Apple event is getting closer and here is what to expect when they launch the iPhone 17 and iPhone 17 Air.

Which one of these iPhone 17 versions will you be looking to get?

Apple Maps users in the Netherlands are now able to access cycling route data on their iPhones and Apple Watches.

Locations currently supported are:

Apple Inc. is one of the largest and most successful technology companies in the world. The company is known for its innovative products, including the iPhone, iPad, and Mac, which have revolutionized the way we communicate and work. However, one of the most interesting aspects of Apple’s success is its cash reserves.

As of the end of the second quarter of 2021, Apple had a staggering $193.8 billion in cash reserves. This is a mind-boggling amount of money, and it’s hard to imagine just how much it really is. To put this in perspective, this is enough money to buy roughly 3,876,000 Tesla Model S Plaid cars, or to pay the yearly tuition fees of over 2.6 million Harvard students.

So, why does Apple have so much cash? Well, there are a number of reasons. First, Apple is an incredibly profitable company. In the second quarter of 2021 alone, the company generated $89.6 billion in revenue, with a net income of $23.6 billion. This level of profitability allows Apple to generate significant amounts of cash each quarter.

Second, Apple has a history of being very conservative with its spending. The company is known for being very disciplined when it comes to investing and spending money. This means that Apple has historically been able to generate significant amounts of free cash flow, which it can then use to build up its cash reserves.

Finally, Apple has also historically used its cash to invest in research and development, as well as to acquire other companies. This strategy has allowed Apple to stay at the cutting edge of technology and to continue to produce innovative products that consumers love.

In conclusion, Apple’s cash reserves are truly staggering, and they are a testament to the company’s incredible success and profitability. While some may argue that Apple should do more with its cash, there is no doubt that the company’s conservative approach to spending has helped it to build up a truly impressive war chest.

Apple announced back in February that they were going to launch Tap to Pay.

Tap to Pay is a new feature that will enable any merchant to accept payments with only an iPhone – this could obviously really hurt companies that take a cut in the middle like Square or Stripe.

This is going to be an amazing feature for small businesses – who wont need any new hardware or contracts. Just an Apple phone and a dream!

Now, it turns out that Apple is already testing the feature at its own Apple Park visitor center in Cupertino.

Some hot news for those of us that have with held buying an iPhone (all 2 of you). Word on the street is that Apple has had an excellent 4th Quarter, and with sales of iPhones surpassing previous estimations, there is some wiggle room when it comes to price.

The iPhone which currently resides in an exclusive contract with AT&T, sells for $199 with contract. Millions and millions of people jumped on board with the first iPhone came out, and the second generation was just as popular. With over 15 million iPhone sold worldwide, it has dominated the mobile market. Outstanding sales have given Apple a cushion in case the current economic downtown starts to effect sales, they can afford to drop the price of the iPhone to $99.

What would a $99 iPhone do to the market? For starters, with such a low barrier to entry, the iPhone will clearly bleed further into the consumer market, even those on the fence would be tempted to purchase, and the market dominance would only leave true niche mobile companies like Blackberry able to withstand the onslaught.

Conjecture? Possibly, but only time will tell. Get those Christmas wish lists ready and stay tuned for more info!